We’ve all been there – you go to pay for a purchase with a check, only to have it declined. It’s an embarrassing and frustrating experience, and the reasons behind a check rejection aren’t always obvious. When it comes to Certegy, an independent risk management company that processes payments between merchants and consumers, understanding why your check was declined can be especially difficult.

Overall, there are many potential causes for why your check may have been declined via Certegy, but rest assured that most times, it is done out of precaution rather than malice. Following proper protocol, understanding all relevant risk factors, and maintaining accurate records associated with all relevant accounts should help ensure smooth sailing next time!

Why Did Certegy Decline My Check?

Certegy declined the check due to a lack of history on file, unpaid debts, human errors, previous adverse history, previous cases of foul play, and additional risk factors.

Certegy declines checks for various reasons, ranging from lack of history on file to unpaid debts or even previous cases of foul play. Let’s take a look at some of the most common reasons that Certegy may reject your payment:

- Lack of History on File: Certegy may decline a check if it doesn’t have enough information about the customer in its system. This could happen if you’ve never used your account with them or if you haven’t used it in a while and they don’t have recent information on file. In this case, they need more time to verify whether or not you are who you say you are before approving your transaction.

- Unpaid Debts: If you owe money to another business that uses Certegy’s services, they may flag your account and decline any attempts at payment until the debt is settled. Following their Terms of Service, Certegy reserves the right to refuse any transaction if any outstanding debts are due from the customer.

- Human Errors: As with any system run by humans, mistakes can sometimes occur when processing transactions through Certegy’s system. These errors could include incorrect data entry or identity verification methods being used. Either way, it’s essential to try entering your information again and double-checking that everything is correct before purchasing to avoid being flagged for potential fraud by mistake.

- Previous Adverse History: If you’ve had problems with payments in the past – whether related to fraud or non-payment – then it’s likely that this will be visible in the background checks performed by Certegy when verifying transactions. Being open and honest upfront about any issues can help prevent unnecessary delays or declines while making a purchase using this service.

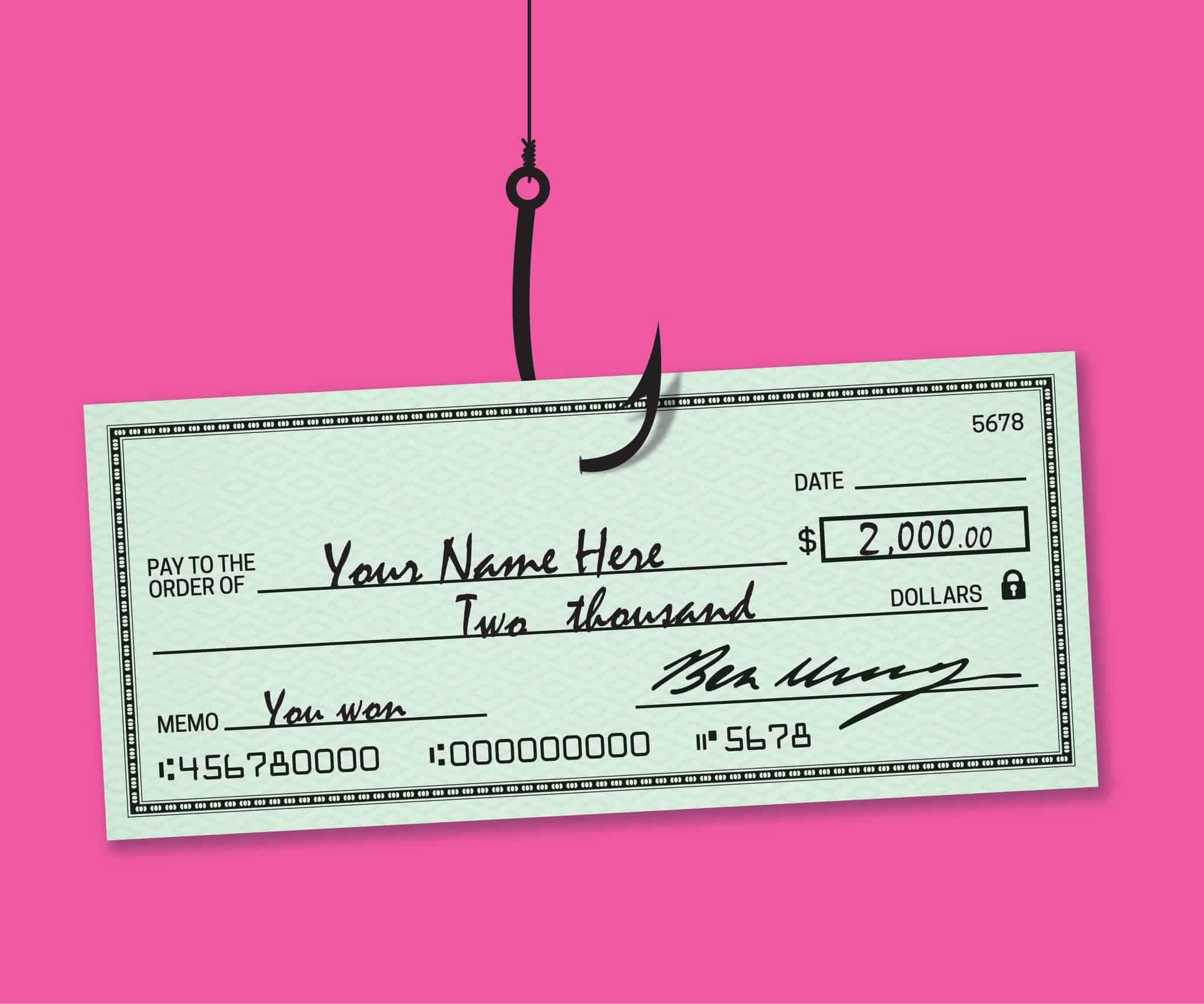

- Previous Cases of Foul Play: Just as is valid with any other financial institution, if fraud has been detected or suspected about an account associated with yours, then this will likely be flagged by their security measures when trying to process payments through their service. This could result in delayed transactions or outright denied charges until the security team has completed a further investigation into fraudulent activity at Certegy.

- Additional Risk Factors: Lastly, even if none of the above factors apply directly to your case, there may still be other risk factors that cause them to deny payment via their services, such as expired credit cards or insufficient funds available for transaction completion. Customers must keep up-to-date records of accounts associated with their Certegy profile so as not to run into these issues when making purchases online or in person using this service provider’s payment system.

Certegy can consider you a danger if you don’t write checks regularly or have never done so. Because of the age-old debate about whether or not the chicken or the egg comes first, you can do nothing in this case. By building a successful track record, you can alleviate this risk issue. You can establish a good history by initially using a check for less expensive transactions. Writing your first check for over $1,000 is probably not the best idea.

Merchants can refuse to accept your check if you have a bad credit history with a banking institution. Various unpaid debts from the past, such as delinquent bank accounts closed without negative balances, can be the cause. According to Certegy’s official site, “We can seek to verify funds with the financial institution,” depending on the facts of your check transaction. Depending on the circumstances, it might be about your current or previous account abuse.

Customers who have had a bad experience with Certegy are the most apparent target. If Certegy has already classified your information as high-risk, a retailer is considerably more likely to reject your check. It depends on the person who wrote the check. Certegy can refuse your check because of your history of writing bad checks (checks written with insufficient money) or attempting to “float” a check (checks written with the expectation that extra funds would be available before they are cashed). This might still significantly impact your credit score even if you’ve already paid for prior transgressions.