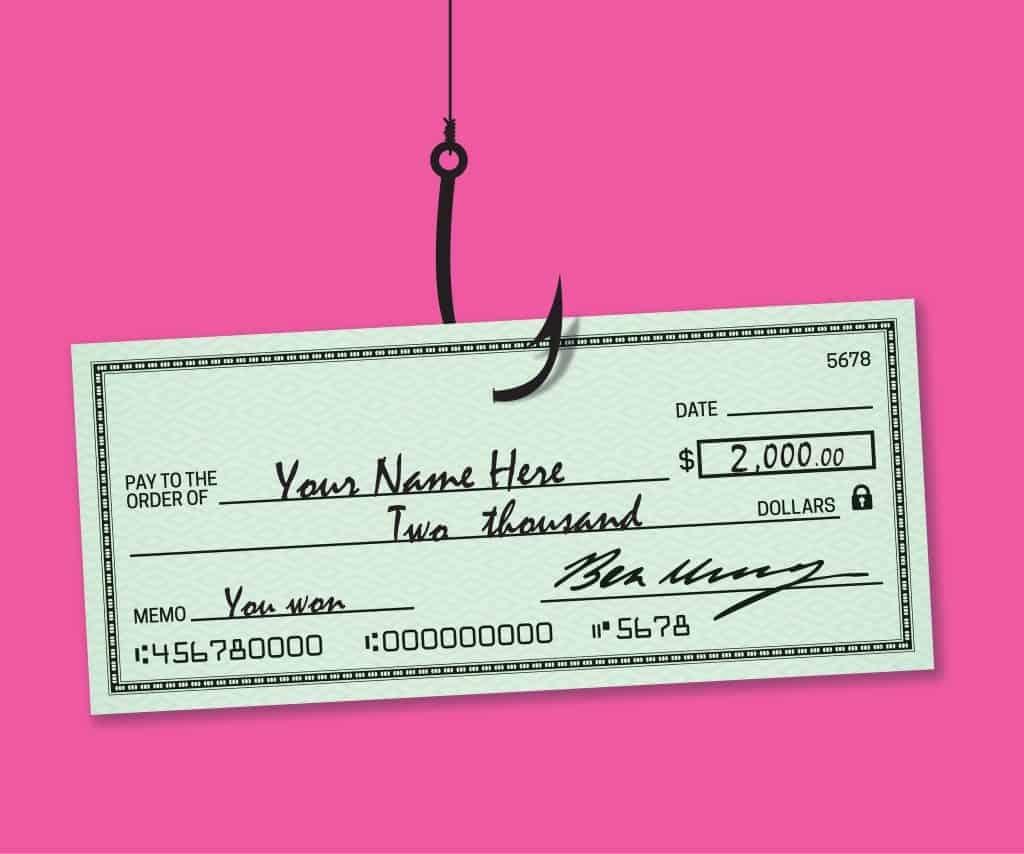

CSC loan servicing sent me a check. What should I do?

A check is a financing proposition that is not requested. If the loan requires repayment at high-interest charges, you will be bound to its terms if you deposit or cash it. Ensure you know the rapports and circumstances of a live check before cashing or depositing it. Look into other financing options to determine whether or not a lower rate is available.

Did you receive a cheque in the mail that you weren’t expecting? Checks, not pre-approved loans or loan offers for live checks, are sample adverts, fake checks, and checks you owe back.

Why Did I Get a Check from CSC Loan Servicing?

You got a check from CSC loan servicing as the unsolicited loan offer. Usually, when you receive such a check in the mail, you should avoid cashing in. If you cash or deposit the CSC loan servicing check, you will be bound by loan terms, which usually include high interest rates for multiple years.

You should avoid unsolicited financial aid offers!

What does payment in advance consist of?

A live check is a pre-approved or “preview” finance proposal that has not been requested. You can get a loan from a mortgagee you’ve dealt with earlier or someone completely new. In most cases, borrowers may expect to borrow anything from a few to several thousand dollars. The following must be included in the check:

- A breakdown of the fees associated with borrowing

- The annual percentage rate (APR) must be considered when calculating a loan’s yearly cost.

- The method of payment

- The terms of the loan settlement

- An explanation of how your data will be shared.

- A withdrawal notification, which allows you to stop receiving future offers, is a legal notification that you have this right.

- Sender’s contact information

You should shop around and compare terms before taking a live loan check, as the interest rate on one may be greater than on other private lenders or credit cards.

Whether or not this prior authorization loan deal is a fraud depends on your perspective.

Con artists may lead counterfeit loan proposals through postal service, correspondence, or typescript messaging. These may seem like authentic live check lending offers, but they’re scams to steal private or monetary information. The Federal Trade Commission has information about check fraud.

To borrow money, do I need an active check?

Since no loan request or paperwork is required, sentient check advances might be helpful. On the other hand, loans with live check deposits may have substantially greater interest charges than standard lends or credit cards. If you’re considering taking out a mortgage or a credit line, weigh the paybacks and drawbacks of all your options. You should do a background check on them to guarantee that the live check mortgagee is genuine and not a scam artist. The excellent approach to retaining your credit score and avoiding spending cash on interest and bills is to make a financial plan and protect your requirements rather than taking out a loan or credit card.

In what way does a real-time check work?

If you agree to take the live check advance, you should sign the check back and cash or deposit the assets into the bank account once you have endorsed the bill. The loan agreement’s provisions generate debt that you must repay. Defaulting on a loan and failing to make timely payments may result in late fees and interest, a possible black mark on your credit record. To cast off the loan proposal, shred and discard the live check properly to avoid unauthorized usage.

How can you avoid getting unsolicited financial aid offers?

A borrower’s ability to repay a live check loan is mainly determined by the information included in their credit report. The Fair Credit Reporting Act allows you to drop out of getting live checks or other unsolicited loan deals for five years. Call 1-888-5-OPTOUT (1-888-567-8688) or go to OptOutPrescreen.com to drop out for five years. A take on the “Perpetual Dropout Choice procedure” will be sent to you when you request it from OptOutPreScreen.com. Learn how to reject loan offers you don’t want.