It is tough to get a loan even if you are taking it for a better purpose, and getting a loan will become even more challenging if you are under 18 or so. Many people apply for loans from banks for credit funds to purchase their car, buy a house, or pay for their educational funds.

From one state to another, each government has a different set of rules for its bank to provide loans in points under categorical policies. Therefore, people who have taken a loan previously and have no good credit history, that is to say, they have not returned their money on time or are not legible to get another loan, or it may become challenging to get another one similar those people for young adults who are under the age of 18 and or ambitious to start their business or have some other ideas like to buy a car or a house, or maybe they want to pay their education of funds to apply for the loans too, from the bank and get rejected.

How to get a loan at 18?

To get loans, 18-year-olds in the United States must analyze lenders offering special credit for young people without a credit history. Although 18-year-olds are legally allowed to sign for credit, they need to show the lender they have income and a checking account.

It is mentioned above that a person in the credit lender profession, even the banks, follows the policies and searches for your credit history if you are applying for a loan. However, for those with no credit history, like young adults, credit lenders for banks may hesitate to allow you to have the loan.

But it is not comfortable or more accessible to say they will reject you at first glance; you still have a chance to apply for the first loan, as everyone has to start somewhere. However, those under 18 have to wait a little longer to get the long process since they will have to take another route to get the security check done and have a legibility vote from a financial institution.

First, you must be clear that you are flying to get a loan. Once you are cleared and help with all the documents you send, you can easily convince your guardian or your parents before you go to credit lenders for banks. You will be a cosigner for the loan, and your guardian and parent will be the best choices. There are different types of loans, and only the kindcosignerrom cosigner is the educational funding loan that doesn’t cosigner co-cosigner you are applying for a loan to pay your educational dues.

Can I Get a Loan at 17?

Yes, you can get a personal loan at 17 as a person under 18, but only as long as you have a parent or cosignerucosignerner on your loan. You must legally sign a loan contract at least 18 years old. However, you can get a student or a cosigner if you are below 18.

The ‘defense ‘of infancy’ does not’ apply to federal student loans, so you can use it for stloanssigner.

If you need a loan to buy a car, then see the video below about car loans and teenagers:

The process to get a loan for young adults.

First, you must make an appointment with the bank or credit lender; either will be a better choice to complete your documentation before leaving your residence. Here, it will be a great choice to choose the credit lender for the bank officer via your parents or guardians who already have their accounts. This way, it will be easy for you and your garden to reach out to the officer and get a chance to get a higher higher loa,, too. You can even negotiate for a better interest rate.

The first step is always the completion of the application. The officer will ask you to do this step in person, even if you are at home and completing the application online. If you are in the bank or the correct lender’s lender, you must do it yourself and be present.

Here is a little tip: before applying for a loan, whether for educational purposes or any other, you need to review the loan and bank policies thoroughly. You must know beforehand which policies will be beneficial and which will not.

You may get rejected by the first credit lender you apply to, so you must keep applying for a loan until you get the required one. If one of your guardians or parents has a clear and robust history, this will also help you get accepted to the cosigner. CocosignercrCosignerory can also affect your acceptance of getting known.

Students who are In the race to become successful. They are usually desperate for education, car, or house loans. Sometimes, it becomes overbearing when limited resources and a stringent set of policies restrict a stream; many students get more money as a loan. Getting a loan is a rigorous and complex procest of all, you need to understand that banks or credit lenders are not doing the charity business; they are most concerned about whether the credit or loan taker is capable enough to return the amount. So, for this case, you have to be clear and robust enough to convince them about whatever purpose you are taking the loan for and convince them that you will be paying them back and when.

So before that, you must be sure that your guardian or parent who cosigns your cosigner is cosigned enough. If you can convince them, the journey ahead will be more straightforward than you have thought. In more detail, the process may take the initiative after providing substantial proof that you are a strong candidate to get the loan, but the process might take longer.

There are five points you must be sure about, and they are as follows.

- Who: What is your name? What can you bring to the table for the bank?

- What: What is the purpose of money? A bank is much more likely to lend money to someone who wants to build a house extension (and hence increase the value of their home) than someone who wants to spend the money on discretionary or disposable items.

- Where you apply for a loan might significantly impact whether or not you get it. This is because lending criteria differ between a traditional bank and an online financial institution across different geographical regions.

- When: The loan’s teloan’sth the interest rate and the loan’s duloan’s—determine when the bank can start making money.

- How: How does the bank know you’ll beyou’llto repay the loan according to the terms? How can you ensure repayment or, at the very least, mitigate the bank’s ribank’sw to Get a LoCosignert a Cosigner?

YCosignert the loan as a cosigner cosigner in two ways. The first is to provide proof of your income and an excellent financial profile. If the lender rejects you, you can ask other lenders and credit unions. Additionally, you can get a student cosigner’s cocosignerAscosignerly said, “T”e ‘d’f’ ‘se ‘infancy’ ‘does not apply to federal student loans so that you can apply for student loans without a cosigner.

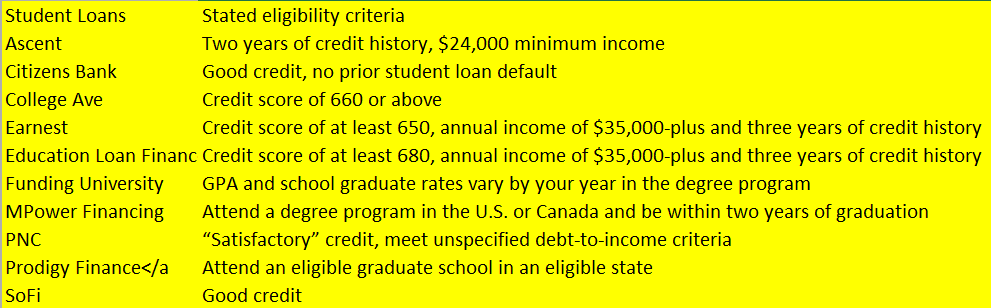

“lecosignerurrent offers for private student loans in the US:

How do Banks Usually Decide?

If you can pay the money back later (or you have the resources to back your mortgage), the bank won’t dime. These are a few crucial aspects of your finances.

Collateral

What significant assets could the bank take if you default on your loan? Your home or automobile are typical examples of collateral.

Credit

When you apply for a loan, your credit score is considered. If you have adverse credit, you will have difficulty securing a loan unless you are ready to accept less favorable loan terms (like higher interest rates and lowered limits).

Income – Payscale

Your lender will want to ensure you can afford to repay your loan. Lenders are more comfortable with higher-income borrowers.

If you dodon’tpappdon’toe the ideal loan candidate, you will likely be stuck with higher interest rates and fewer credit options. And if you have few assets, poor credit, and are just scraping by, lenders are unlikely to contact you.

You might be able to match your approach to those crucial elements if you know what lenders look for. For example, if you dodon’tahavdon’teo create an excellent credit history and dodon’tahavdon’tollateral to provide, getting your paparents’aparents’eay be the best way to avoid a higher interest rate or outright rejection.

Even if you’ve acquired equity by paying down your mortgage or your house’s price has increased significantly, you can use a home equity line of credit or a home equity loan to access the funds. These financial products, like mortgages, were related to your property and enabled you to meet specific qualifications. Still, they differ because you can use the money for various functions.

Try HELOC Credit Union

HELOC means home equity line of credit. Of course, you can use home equity loans to work differently, but they have different meanings, functions, and other pros and cons. Here are the details to help you understand both of them quite profoundly.

Following are the pros and cons of Home Equity Loans and HELOCs.

You might view your home equity as extra worth after you have outstanding loans on the property. For example, suppose you have a mortgage on a house. In that case, your home equity is simply the current market value minus the momortgage’mortgage’sgoan sum, which you can find on your most recent statement. Because many factors influence your hohome’samahome’sorthan appraisal or research may be required.

Pros and cons of HELOC

If you compare home equity loans with I ck, you will find that HELOC offers a more significant advantage in terms of flexibility. In this case, it will also help you gain more periods and avoid taking more loans, and you can also save more money by keeping interest rates.

Payback becomes more accessible when paid as interest-only payments, and you will also get low interest rates, as with a home equity loan. Moreover, if you depend on a credit lender, you will avoid a closing cost with the help of using HELOC, and you will also get the opportunity to get a fixed interest rate. Regarding this home-related matter, you may also enjoy the tax benefits.

How Can You Borrow Money From equity?

If you are deciding between taking a loan using home equity or HELOC, both equities have pros and cons, and this will help you consider which of them will help you get money as a loan. If you are clear about the amount you have to take as a loan, find and prepare to draw the predictable amount payback 10; going with the home equity loan would be the best choice over here, full stop; it just depends on the situation you are in.

For the second option, HELOC can be a good option you are planning to have then you will use it with different intervals or a different set of the period, for example, loan for home renovation or any other thing to find money in an additional time and secondly your preference to have low-interest payback payment while you are accessing to that of the credit line. So, if you are uncomfortable with either of these options, consider the other options and cash-out refinance.

How To Know If You Qualified Or Not?

Here is the most crucial question you might be wondering about and unconcerned about. It is to know whether you qualify for a loan or a home equities loan. There are different sets of rules and requirements. And if you are eligible or not, you have to read a mouth you are is different that is being researched on and noted. Following its factors:

1- Your home equity – most of the landers most likely required a minimum of 15 to 20, so we should be getting a mortgage of your home and estimate the value of 8 to see meeting the requirement or not.

2- Your credit – to get the home equity financing decrement rate would be as high as a 700 credit score of your credit.

3- Debt and income – HELOC or home equity loan will add another amount for you to pay back. Landers will be considering that if you have a suitable income that will support you back their money or if you have any debt already on your shoulder that and you on your application that you have to pay back before you are getting the from great leaders both of these would be considered as a significant factor before there are allowing you or granting you to have the loan.

Final Say

Let’s start with young individuals. Cosigner possess the five characteristics banks seek. Therefore, the easiest way to make lenders compete for your business is to address these issues positively. If you are 17 years old and need a loan, you can try to get a student locosignerut a cosigner.