When managing finances, one question often arises: “Do unused checks expire?” The answer isn’t as straightforward as hoped, mainly due to the varying contexts and regulations surrounding different checks. In this article, we will explore the lifecycle of unused checks, discuss the factors that might render them invalid, and offer advice on managing your checkbook to avoid potential issues.

To address the question directly, in theory, unused checks – those that have been ordered from your bank but haven’t been written yet – do not come with an explicit expiration date. However, they can become “stale” over time due to various factors, which we’ll explore further.

Do Unused Checks Expire?

Yes, new, unused checks usually expire after six months. For example, all personal, payroll, and business checks are suitable for 180 days. However, if you have a business check printed “void after 90 days”, the check expiration is 90 days.

In the United States, the Uniform Commercial Code provides a general guideline that banks are not obliged to honor personal, business, or payroll checks over six months old. This 180-day period essentially acts as a default expiration date for checks. However, this does not mean that banks are legally prohibited from cashing older checks; it simply means they can reject them at their discretion.

Some business entities print “void after 90 days” or similar language on their checks. This is often done to improve cash flow management and maintain accurate financial records. By encouraging payees to deposit or cash checks sooner rather than later, businesses can ensure that their recorded financial liabilities align closely with their actual cash flow situation.

Although a check may state void after 90 days, most banks will still honor these checks up to the 180-day mark, per the Uniform Commercial Code’s guideline. Again, this is at the bank’s discretion and not legally required.

It’s important to note that these rules can differ for U.S. government checks, also known as Treasury checks, generally suitable for one year after the issue.

In conclusion, while there is a general guideline for the expiration of checks in the U.S., it’s best to cash or deposit checks promptly to avoid potential complications. If you have a stale check, it’s recommended that you contact the issuing entity to request a reissue, as attempting to cash an old check can result in it being returned unpaid.

Factors Leading to Effective Expiration of Unused Checks

While it’s true that unused, blank checks don’t technically expire, they can become obsolete or potentially problematic if used after a significant amount of time. Here’s why:

- Account Status: The most common reason an unused check might become invalid is to your account. If you close your account or it becomes dormant due to inactivity, the bank will not honor the check linked to that account.

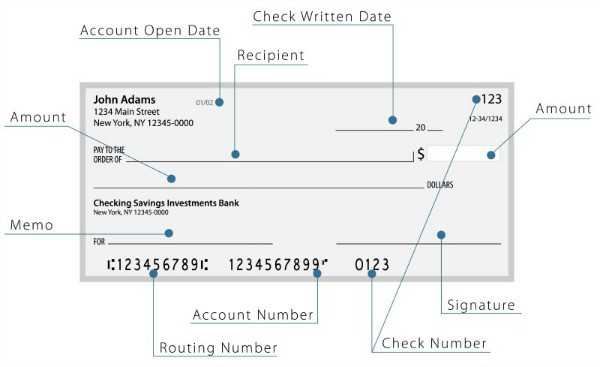

- Banking Information Changes: Banks sometimes undergo changes that can affect your checks. They may change their routing number, merge with another bank, or even leave the business. If you have an old checkbook, it might have outdated information that could lead to your check being rejected when presented for payment.

- Suspicion of Fraud: Due to the rise in check fraud, many businesses and even banks are wary of older checks. If your checks look aged, they might raise red flags for fraud, potentially causing a recipient or a bank to refuse the check out of caution.

- Changes in Check Security Features: Banks periodically update the security features on their check stock to deter fraud. If your checks are old, they might lack the latest security features, making them susceptible to rejection.

- Personal Information Changes: If you’ve moved, changed your name, or made other significant life changes, the personal information printed on your checkbook may become outdated. While this doesn’t necessarily invalidate a check, it can cause confusion or suspicion.

Best Practices for Managing Unused Checks

Given the potential issues associated with using old checks, it’s wise to follow some best practices when managing your checkbook.

- Regular Review: Review your unused checks regularly for outdated information. If they are outdated, contact your bank about getting a new set.

- Minimal Orders: Order only a few checks at a time, especially if you don’t use them frequently. This can help ensure you use your current checks before they become outdated or suspicious.

- Secure Storage: Keep your checkbooks in a safe, secure place. This protects against theft, helps keep them in good condition, and reduces the chance of them appearing aged or suspicious.

- Electronic Banking: When possible, consider using electronic banking methods. Online bill pay, electronic transfers, and mobile check deposits often provide more security and convenience than traditional paper checks.

Conclusion

While unused checks don’t technically expire, they can become unusable due to changes in banking and personal information, suspicions of fraud, or alterations in check security features. To avoid potential issues, it is prudent to review your checkbook regularly, update it as necessary, and move towards electronic banking methods. This way, you can ensure a smooth financial transaction process using checks or digital means.