In the banking sector, we can often hear questions about reference numbers.

What is a bank reference number?

The Bank Reference number represents a unique identification number applied to different financial transactions. For example, if you make a credit card transaction, the bank will assign an identification number and monitor that transaction associated with a card.

A reference number must be assigned to identify any business transaction, even those made with a debit or credit card. Technically, a benchmark number specific to a single business operation is generated. When a reference number is assigned to a transaction, it helps an institution identify it in records and electronic databases. For example, each transaction on a user’s account is typically referenced in the bank statement.

How do you find a Bank Transaction reference number?

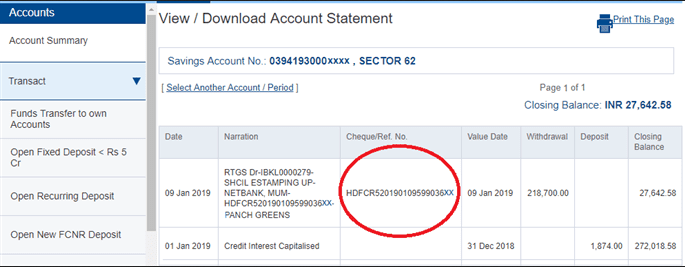

To find the transaction reference number in your invoice or bank statement, look for a long number that usually has 20 to 30 digits.

See below:

However, some bank statements can have short reference numbers.

The bank transaction reference number can be found in the detailed bank statement in the online banking section. Usually, you need to click on the ‘transaction details’ or ‘narration’ in your bank account statement.

Reference numbers characteristics:

- Reference numbers are random numbers and letters assigned to credit or debit transactions as identifiers.

- Reference numbers make it easier and faster for customer service representatives to respond to information requests and answer inquiries.

- Credit card and loan applications, merchant receipts, and customer service reps can provide reference numbers.

Financial institutions use reference numbers to facilitate the compilation and querying of millions of transactions. Once a transaction has been completed, a random combination of letters and numbers is generated. For example, certain withdrawals and deposits, cash deposits, money orders, and bill payments are typically assigned reference numbers.

How do you track bank reference numbers?

To track the reference numbers, you need to log into your bank platform, go to the transaction list, and monitor for any change in the transaction. Once the transaction is settled, you will see the reference number and all details and transfer status related to it.

In addition to printed statements, cardholders can access their online banking statements at any time. Cardholders’ credit card statements provide an overview of all transactions they’ve made during a specified time frame. By regulation, card companies must instruct cardholders on reading and fully comprehending the statement’s various sections.

Some companies refer to a reference number as a file number.

Special Considerations

Customers can communicate with customer service representatives more quickly when they have a reference number to refer to. Consumers can report transactions that they believe are questionable to a representative, who can then investigate the transaction using their database to obtain more information. For example, if a customer does not know the store or date of the transaction, they may refer to it as “transaction 123456.” Transaction metadata in the card company’s database contains the transaction’s descriptive elements.

Referencing each transaction helps to speed up the resolution process for all transaction queries and fraudulent charges. In addition, a transaction’s reference number allows card companies to track detailed information about the transaction. This number enables the company to identify the merchant, seller, and terminal or terminal owner who executed the transaction using the reference number.

Cards compromised or used fraudulently can have charges reversed using the reference number while still pending approval.

Types of Reference Numbers

In some cases, referral numbers may also be issued in response to customer service inquiries and phone calls. Consumers who inquire about products or services over the phone may be given a reference number to quote when they return to complete the transaction at a later date. Referral numbers provide merchants with operational transaction details. Merchants can use reference numbers to identify and track every transaction made through their company.

Credit card or loan applications may also be assigned reference numbers. As in the previous example, the issuer or provider determines the location of the reference number. It’s usually found at the end of an application form or in an email or letter from the company. Most reference numbers will be listed at the top of the application submission form, which appears after an application is submitted. Follow-up emails or letters from a company are usually quoted at the top. Many companies provide credit card or loan reference numbers, while others do not.

What Is a Contact Number?

A reference number must be assigned to identify any financial transaction, including those made with a credit or debit card. Technology allows for the creation of a unique transaction number. Certain withdrawals and deposits, cash deposits, money orders, and direct debits are typically assigned reference numbers.

Companies use referral numbers for various reasons. For example, financial institutions use reference numbers to make millions of transactions easier to compile and query millions. Once a transaction has been completed, a random combination of letters and numbers is generated. Certain withdrawals and deposits, cash deposits, transactions, and money orders are typically assigned reference numbers.

Why Is It Important to Use Reference Numbers?

Referencing each transaction helps to speed up the resolution process for all transaction queries and fraudulent charges. Customers can communicate with customer service representatives more quickly when they have a reference number to refer to. Consumers can report transactions that they believe are questionable to a representative, who can then investigate the transaction using their database to obtain more information.