In today’s digital era, it is possible to cash a check online instantly. Electronic payment technology has enabled us to make faster financial transactions and securely transfer money from one account to another, making cashing a check much easier and more convenient than before.

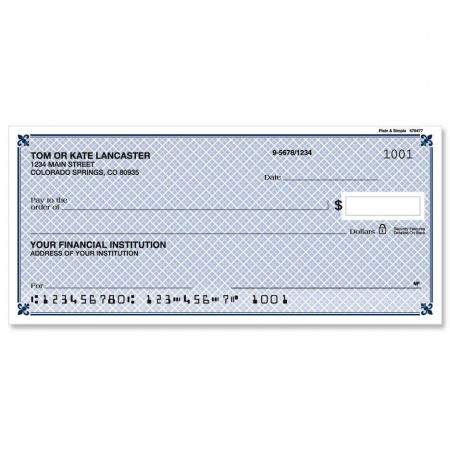

The idea of cashing checks online started with companies offering remote check deposits. Customers would scan, photograph, and upload their paper checks to transfer the funds electronically. But now you can go further and cash the check without waiting for the deposit to clear.

How Can I Cash a Check Online Instantly?

You can cash the check online using apps like Brinks Money, Ingo Money App, PayPal, Green Dot, etc. The online application might require a small fee of $5.

Cashing checks online also provides added security features, as you no longer have manual processes to handle large volumes of paper money. The process is also fast, as it usually takes two or three days for your payments to be credited directly into your bank account. Depending on the provider, you can receive your money within minutes or hours after initiating the transaction.

Several online services, such as Brinks Money, Ingo Money App, PayPal, Green Dot, and more, allow you to cash a check instantly. Each service has its requirements and fees associated with it; however, most require minimal effort from users and charge nominal fees (typically around $5) for using their services.

Most of these services use Optical Character Recognition (OCR) technology, which scans the data written on each check, including the amount and payee name, so that they can validate it against information stored within their databases or present in credit bureau reports. This additional security measure also helps protect customers from fraudsters who may try to exploit loopholes in banking systems by submitting inaccurate information for electronic payment processing, such as fake checks, stolen credit card numbers, etc.

To cash a check online efficiently with any of these applications, firstly download the app onto your smartphone or tablet device and create an account with all your details, including address proof documents like driver’s license/passport/utility bills, etc., along with your bank details -this will help ensure smoother transactions later on down the line when cashing out funds received via cheque payments, etc. Then enter all relevant information about the cheque into the app, such as recipient name, payer name (if available), amount, etc., before uploading an image of both sides of the cheque- digitized images are important here since they ensure accuracy while manually entering data fields by reducing errors due to misreading text fields, etc. As soon as all required information is entered correctly into their system, funds will be sent over almost instantly to your linked bank account!

You can get a MasterCard debit card via Brink’s Money Prepaid Mobile App, which offers the same advantages as bank debit cards. You can add money to your Brink’s card by writing a check, making a direct deposit, transferring cash from another Brink’s card, or a bank account. You can deliver paychecks 1 to 2 days faster if you sign up for direct deposit. The third-party costs for check-cashing might vary at any time. The charge for expedited services ranges from 2% to 5%, or a flat fee of $5.

Payroll check cashing has never been easier than using the Ingo Money App. Your user profile must be linked to at least one debit, prepaid, credit, or PayPal account. A check can be cashed by simply taking a photo of it on the app and then selecting a delivery time and location. Pre-printed payroll and government checks cost $5 each, or 2% of the total. Reloading a Netspend prepaid debit card is a breeze with the app, eliminating the need to visit an ATM. Payrolls can be deposited directly into your bank account two days before the due date. For regular service, there is no charge to load a mobile check. Approximately 5% of the check’s total value, or $5, will be charged for expedited service. When to use the app: Netspend accounts can send money to friends and relatives.

Overall, cashing checks online has become increasingly popular due to its convenience factor as well as the added security measures it offers over traditional methods, which typically involve the manual handling of large amounts of paper money, which tend to take days, if not weeks, for deposits clear depending on banks involved in processing transactions, etc. So whether you’re looking for quick access to emergency funds or want an alternate way of processing payments quickly, cashing checks online through apps like Brinks Money, Ingo Money App, PayPal, Green Dot, etc., is worth checking out!