Millions of people would love to win a lottery someday. Winning a lottery certainly can be a fun thing to dream about, and in addition to that, you can do lots of entertaining things with the enormous jackpot you win. The lottery is an opportunity or a probability of winning monetary prizes. They are trendy and considered legal in most countries. A lottery appears to be a straightforward process in which a small amount is spent to win a significant amount. Despite the game’s excitement and curiosity, there are comparatively low odds of winning as a random drawing and selection of the winners. The concept of lotteries is allocated and used in different sports and team drafts or selection purposes. However, a lottery is associated mainly with meaningful financial gains to win a big jackpot. There have been numerous controversies regarding the entire concept, as lotteries are sometimes considered synonymous with an addictive form of gambling. The participants must devote a small amount to win a substantial financial gain.

How do you redeem a winning lottery ticket?

Suppose you have a winning lottery ticket, and your prize is less than $600. In that case, you can redeem a winning ticket from any lottery game to an authorized retailer, such as stores, convenience stores, grocery stores, and other establishments selling lottery tickets in your State. If your prize is above $600, Staten withdraws money to the Lottery Commission in your State (online claim). The price amount will be notified to the IRS, and the state lottery commission and local government will send a 1099 to the winner at the end of the year.

| State | Store receives commission on ticket sales | Winning Ticket Bonuses for stores |

|---|---|---|

| Arizona | 6.5% commission on all ticket sales | $50,000 on jackpot ticket |

| Arkansas | 5% commission on all ticket sales | 1% of prize; max bonus $50,000 |

| California | 4.5 % 6% commission | ½ of 1% of prize; max bonus$ 1 million |

| Colorado | 6% commission | $50,000 on jackpot ticket |

| Connecticut | 5% on every $1 in lottery ticket sales | 1% of prize |

| Delaware | 5% on all games allowed by license | $10,000 on jackpot ticket |

| Florida | 5% on all lottery ticket sales | $20,000 on jackpot ticket |

| Georgia | 6% on all ticket sales | $50,000 on jackpot ticket |

| Idaho | 5% on all ticket sales | $20,000 on jackpot ticket |

| Illinois | 5% on draw games and instant tickets | 1% of prize |

| Indiana | 6% on draw and scratch-off ticket sales | 1% of prize; plus, extra bonuses |

| Iowa | 5.5% on ticket sales | $10,000 on jackpot ticket |

| Kansas | 5% selling commission | $10,000 on jackpot ticket |

| Kentucky | Based on ticket sales goals/performance | Based on ticket sales goals/performance |

| Louisiana | 5% on every ticket sale | Min $25,000 or 1% of LAs contribution |

| Maine | 7% on instant tickets | Up to $50,000 on jackpot ticket |

| Maryland | 5.5% on ticket sales | 1/10th of 1% of jackpot ticket |

| Massachusetts | 5% on ticket sales | 1% on prizes claimed |

| Michigan | 6% on ticket sales | $50,000 bonus commission for jackpot |

| Minnesota | 5.5% on ticket sales | 1% bonus |

| Missouri | 5 cents for every $1 sold | $50,000 on jackpot ticket |

| Montana | 5% ticket sales commission | None (quarterly additional commission) |

| Nebraska | 5.5% on ticket sales | 1% on jackpot ticket up to $50,000 |

| New Hampshire | 5% ticket sales commission | 1% on NH games only |

| New Jersey | 5% on ticket sales | $30,000 on jackpot ticket |

| New Mexico | 6% on each ticket sold | $50,000 on a jackpot ticket |

| New York | 6% with no cap | None |

| North Carolina | 7% ticket sales commission | $50,000 on a jackpot ticket |

| North Dakota | 5% commission | None |

| Ohio | 5.5% on every sale | Up to 1.5% of jackpot ticket |

| Oklahoma | 6% ticket sales commission | Various bonuses |

| Oregon | 5-10% | 1% of prize |

| Pennsylvania | 5% commission rate | Various bonuses |

| Rhode Island | 5-8% | 1% of prize |

| South Carolina | 7% ticket sales commission | Up to $50,000 (cap) |

| South Dakota | 5% | Various bonuses for high tier winning |

| Tennessee | 6.5% of ticket sales | $25,000 on a jackpot ticket |

| Texas | 5% commission on all ticket sales | 1% of jackpot; $1 million cap |

| Vermont | 5.75% ticket sales commission | 1% of jackpot; $30,000 cap |

| Virginia | 5% | 1% of prize |

| Washington | 5% commission | Various bonuses |

| West Virginia | 7% commission | 1% of jackpot; $100,000 cap |

| Wisconsin | 5.5-6.25% | 2% of jackpot; $100,000 cap |

What time can you cash lottery tickets?

You can cash a lottery ticket for 90 days up to one year, depending on the game type and US state. Cash lottery ticket Scratchers tickets expire 180 days from the game’s ending date.

For example, US Powerball lottery tickets expire 180 days from the date the draw on the prize was won.

Where Can I Cash a Winning Lottery Ticket below $600?

Suppose you have a winning lottery ticket, and your prize is less than $600. In that case, you can redeem a winning ticket from any lottery game to an authorized retailer such as stores, convenience, grocery stores, and other establishments that sell lottery tickets in your State.

If you win a lottery price undState00, you can redeem the ticket to an authorized lottery vendor. According to the rules, the winner must redeem the ticket in the same State, but the location may vary. AccStateg to the list of authorized retailers, you can cash the lottery ticket at various stores and places selling legal lottery tickets, including convenience stores or grocery outlets.

For example, I got a winning scratch card, and I took money from a Kroger retail store at the same place where I bought it. However, if you are in a gas station and the store does not have cash, you can go elsewhere. Each store is interested in cashing your ticket.

Can a store refuse to cash a lottery ticket?

Yes, stores can refuse to cash a lottery ticket if they have a problem with cash or make such a decision. However, 95% of all stores will cash a lottery ticket because they have an excellent commission when they cash a winning ticket.

Please see this table below:

Where Can I Cash a Winning Lottery Ticket above $600?

If your prize is above $600, you can withdraw money from the Lottery Commission in your State at the following web address:

[State id=86 /]

According to the state lottery office, the winning threshold is $600. If the end price is labeled as $600, then the price amount will be notified to the IRS, and a standard amount of taxes will apply to the end price. According to recent changes, the federal and State governments vary in their tax applications. 2020 ,the federal government imposed 24% on lottery winnings, and the state government asked for 0 to 13%. At the end of the year, the state lottery commission and local government send a 1099 to the winner, highlighting the win at over $600. In addition, winners who have won less than $ 600 are usually not reported to the IRS. As a Powerball jackpot winner, you can retrieve the money in three options: an instant lump sum, an immediate with a drawl, or an annuity in which the prize money is distributed over three decades. Some US states give 180 days to the participants to make a firm decision, while others only grant 60 days if they opt for lump sum prize money.

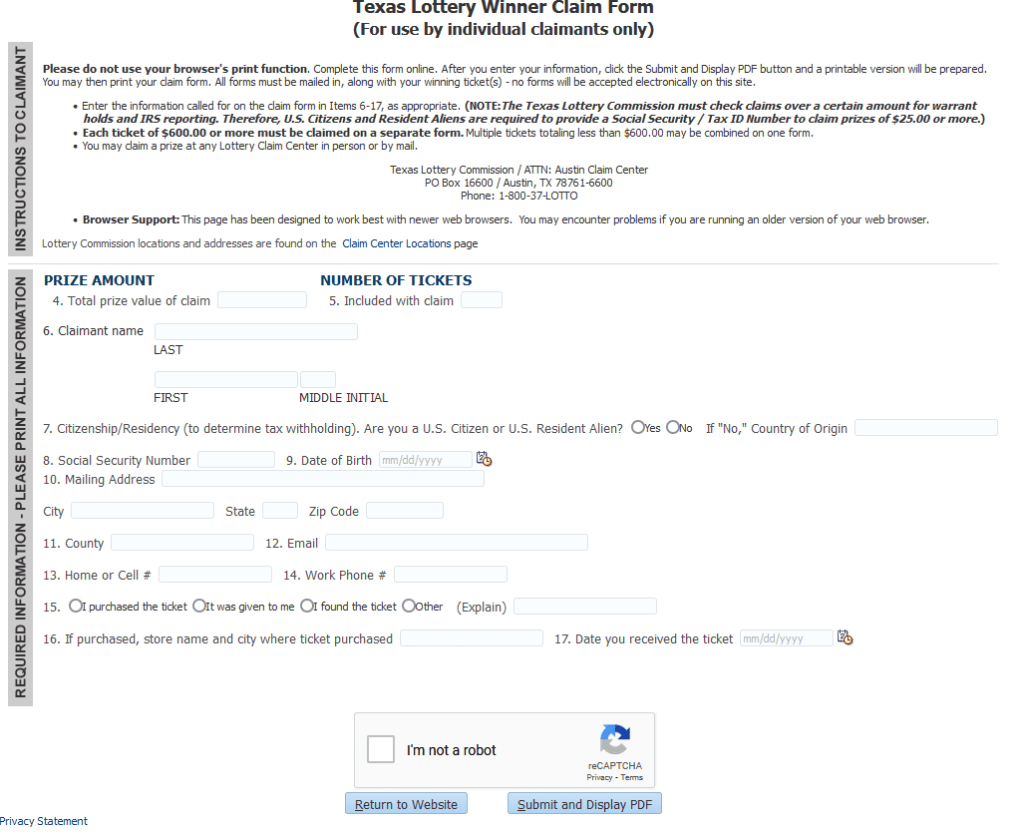

You can claim your lottery prize online. Please see the example below:

Contacting the local lottery office

There is another option of compensating the lottery ticket with the help of the state lottery office. Some of the retailers instantly cash out the winning price amount. To avoid this, winners show a winning amount of more than $600, as many retailers may not have excessive cash available at the office. You can also visit the website to get a new idea about the State’s location and various establishments that can claim the winning amount. You need to sign the ticket at the back to avoid forgery.

Cash claim through the mail

If you cannot visit the state lottery office, you can also redeem the price by mailing the winning ticket and the claim form directly to the lottery office where the ticket was bought. In addition, if the winner resides in a different state and the winning ticket was purchased from another state, you can also use the mail option to redeem the price conveniently.

Suppose you have been fortunate enough to win a large amount of money. In that case, hiring a legal team, attorneys, financial experts, and a certified public accountant is advised to help monitor, arrange, and evaluate the money. Money management is essential after winning a handsome amount of prize money; therefore, it is recommended to act rationally and make sensible decisions after the post-winning process. People choose to receive the funds in 30 installments for over 29 years, but the winners will be asked to pay tax on the entire amount in a lump sum. However, you are only asked to pay taxes with the payments you receive with an annuity, so there is no pressure on large tax payments. This decision should be allotted to the responsible financial team, including lawyers, accountants, and investment advisors, who the winners have handpicked. It is essential to vet the entire process carefully and meticulously to weigh the options for receiving the payment. However, you need to protect your ticket if you have won the lottery before this. Failure to do so will create suspicion, and a lost ticket will not prove the winner’s identity. Make good copies, digital and physical, and protect them. According to financial advisors, if you decide to share the prize money with friends or family, it is essential to be familiar with the process of possible tax amounts levied. After protecting the lottery ticket, you must check how much time you have to claim the prize. If it is a Powerball, every jurisdiction has its own rules, so understanding them before the process is mandatory.

Lottery and state government

The state government typically carries out and operates a lottery y to produce financial deposits or revenue for various purposes. For example, the state government uses the lottery concept to invest in schools, colleges, health systems, and basic infrastructure. The probability and likelihood of winning a large sum in the lottery are extremely low. Still, lucky winners are awarded millions of dollars in a lump sum or paid through an annuity. The tickets can only be exchanged in the same State where the lottery ticket was purchased; otherwise, you must make certain amendments to trade in the prize. A certain threshold set by the state government needs the winners to redeem the ticket at any other location; however, if the cash surpasses the threshold, the participants must cash it from the state lottery office.

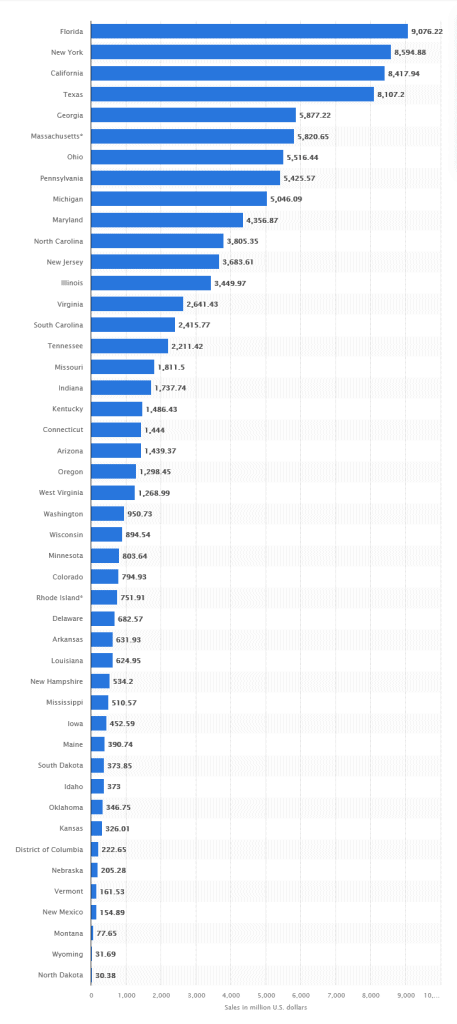

In the end, please see lottery sales by US State:

Florida, New York, California, and Texas have the highest lottery ticket sales in the US.