Budgeting and managing your expenses is not complex, but achieving good results is also tricky. It requires patience, and it takes a close eye on the details of where you are spending and what you are getting. One way to do this is to take advantage of the software and services; you can download and start planning on them and let them update you occasionally.

Surprisingly, free personal finance software is beneficial. It helps you track your spending and expenses, create and manage your budgets and costs, and give you a complete and final report after the month.

The best news is whether your computer has macOS, Linux, or even Androids. If you have a smartphone, you can still find free software to track your finances and help you find a better way to spend your money after a month.

For those who are new today and do not know what software is in the market and what software can be helpful for them, here are some of the subjects and the descriptions with fully featured details below.

The best free budget software

Free software to keep track of expenses is:

- Mint: Mint is a popular budgeting app that helps you manage your money, track your expenses, and create a budget.

- GNU-Cash is free and open-source financial accounting software for personal and small businesses. It offers a range of features to help you manage your finances.

- Personal Capital: Personal Capital is a financial management app that offers budgeting tools, investment tracking, and retirement planning.

- EveryDollar: EveryDollar is a budgeting app that helps you create a monthly budget and track your spending.

- PocketGuard: PocketGuard is a personal finance app that helps you track your spending, create a budget, and save money.

- Goodbudget: Goodbudget is a budgeting app that uses the envelope method to help you manage your money.

- Wally: Wally is a personal finance app that helps you track expenses and manage your budget.

- YNAB (You Need a Budget): YNAB is a budgeting app that helps you create a budget and track your spending.

- Clarity Money: Clarity Money is a personal finance app that helps you track your spending, create a budget, and manage your bills.

- Honeydue: Honeydue is a budgeting app designed for couples that helps you track your joint expenses, set financial goals, and manage your budget together.

- Albert: Albert is a personal finance app that helps you create a budget, save money, and invest for the future.

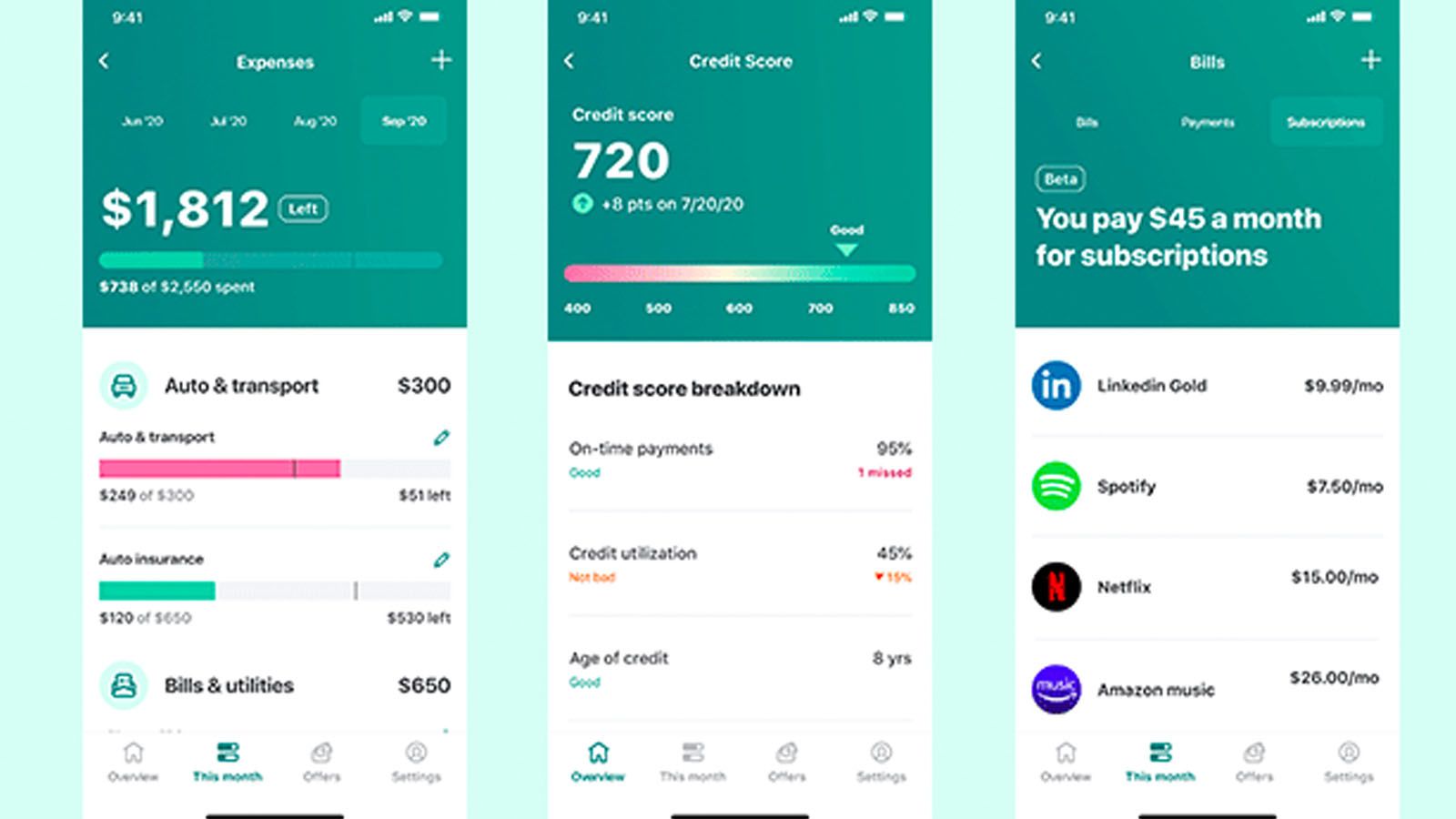

What is Mint?

In the market trend, a free online budget planner is known as Mint. With this App, you can store all your financial data in one place, showing you an overview of higher budget spending bills and how good your scores are. You can create your budget and set your goals for the month, and the App will set up a reminder that you can sync your data between the Web and apps.

Mint Budget Software Features

- Budget Tracking: Mint allows users to create a budget and track spending in various categories such as groceries, entertainment, bills, etc.

- Expense Tracking: Mint automatically categorizes users’ transactions and tracks their spending in real-time.

- Reminders: Users can set up bill reminders to never miss a payment and avoid late fees.

- Credit Score Tracking: Mint provides users with their credit score and credit report for free, as well as tips on improving their credit score.

- Investment Tracking: Users can link their investment accounts to Mint and track their investment performance.

- Goal Setting: Mint allows users to set financial goals such as saving for a down payment on a house, paying off debt, or building an emergency fund.

- Alerts: Mint sends users alerts when they approach their budget limit or when their accounts have unusual activity.

- Personalized Insights: Mint provides users with customized insights and recommendations based on their spending habits and financial goals.

- Mobile App: Mint has a mobile app that allows users to access their budget and financial information on the go.

- Security: Mint uses 256-bit encryption and multi-factor authentication to keep users’ financial information safe and secure.

You fear losing your data, or someone might beat that up. For security purposes, don’t worry. This software’s security is enhanced by a multi-factor authentication feature known as encryption. If you have your investments or any other portfolio, you can track them using the app Mint. This App can be used on iOS and Android because it’s compatible with both software.

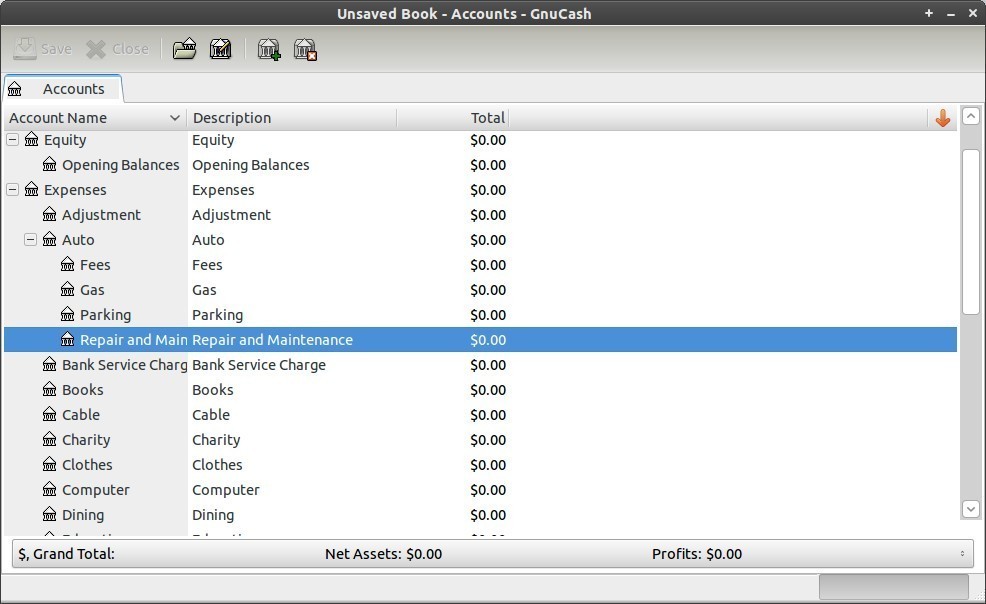

What is GnuCash?

Unlike the apps mentioned above, this is just desktop software; it has features like dragging your bank account stocks, income expense budgets, and monthly expenditures. Isn’t it cool?

GnuCash is a free and open-source personal and small-business financial accounting software that offers a range of features to manage your finances. Here are some of the critical components of GnuCash:

- Double-entry Accounting: GnuCash uses a double-entry accounting system to ensure the accuracy and reliability of financial data.

- Multiple Account Types: GnuCash supports various account types, including bank accounts, investment accounts, credit cards, and loans.

- Budgeting: GnuCash offers budgeting tools to help you create a budget and track your spending.

- Bill Reminder: GnuCash provides reminders for upcoming bills and invoices to ensure you never miss a payment.

- Investment Tracking: GnuCash allows you to track your investments and monitor your portfolio performance.

- Reporting: GnuCash offers a range of customizable reports, including balance sheets, income statements, cash flow statements, and more.

- Import/Export: GnuCash allows you to import data from other financial software and export data in various formats, such as QIF, OFX, and CSV.

- Customization: GNUCash is highly customizable, allowing you to configure your accounts, reports, and data entry forms to suit your needs.

- Multi-currency Support: GnuCash supports multiple currencies and allows you to track transactions in different currencies.

- Security: GNUCash uses industry-standard encryption to ensure the safety of your financial data.

This software has other features that are based on a double-entry accounting for balancing the books, and you can also create several reports of your financial data to see the progress; with this, you can also have other offers like a small business accounting tool that lets you manage customers and Vendor and handling all of the invoices bills and pedals if you’re a small business it’s a more significant advantage to using this software on deck stop, it can help you to track all other financial data we just one AApp, and it suggests you the better report.

Now, for all who want to know if this is compatible with Windows, Mac, and Linux Solaris, the answer is yes, this is compatible with all these software computers.

It has a software app that is compatible with Android. You can use it to track your expense report on your cell phone and later import it into your desktop software to see the detailed report.

Although this era is all digital, there is no hard and fast rule for those who want to keep things simple and concrete. If you are uncomfortable with soft ears or apps, you can use a spreadsheet.

This software and apps are for people who do not have much time to calculate things and want a helping hand from the technology to do all their stuff accurately and with security.

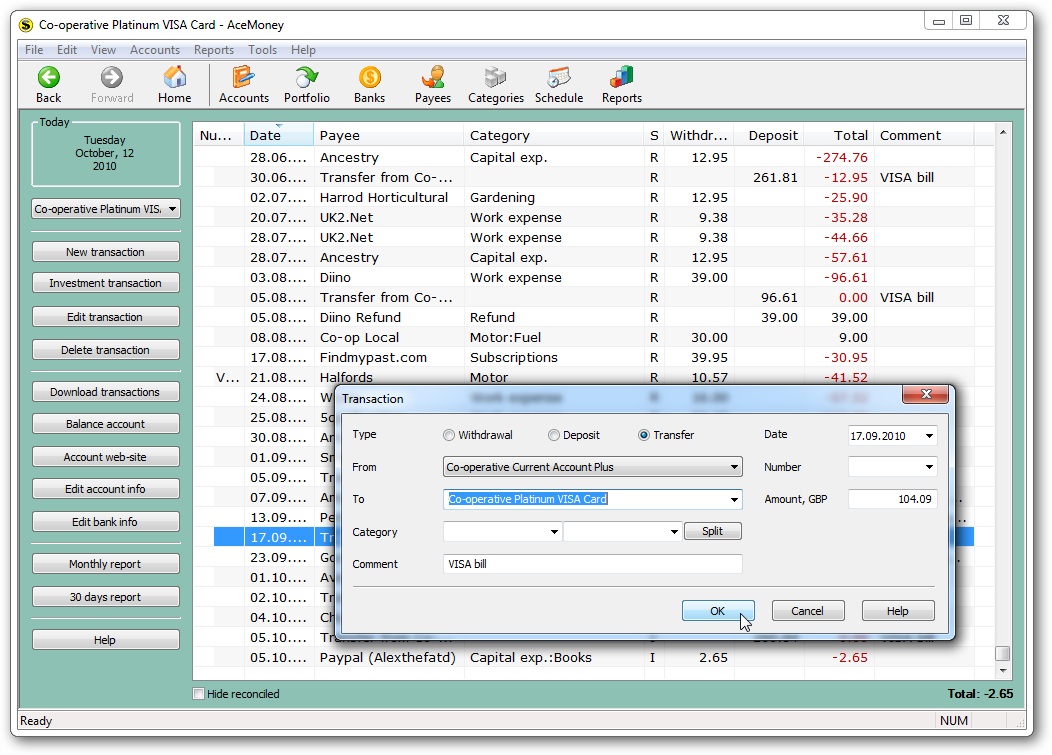

What is AceMoney Lite?

ThAppapp is a Microsoft app. Its best feature is that it builds itself. Other features are as follows: you can manage your budget like others. It can track your finances. Still, here, you have one plus that can handle your finances in multiple currencies, so you are not limited to one currency; it can help you keep an eye on your investment.

So, all in all, it can also help you to Take notice of your spending habits and routine for the week. You can also use your banking system online with the App App App. It is light for you and is limited to one or two accounts. Still, you don’t have to worry about getting the premium or the full version, which will help you get an unlimited budget for personal financing. As for compatibility, Money Light is compatible with all software, whether iit’sWindows or Mac OSx.

You can use YouTube and other videos of this kind of beer for those still having trouble getting more details. Do you know how to use this software, Torio?

The tutorials will help you get detailed information about saving on your bills and getting the suggested report.

What is a Free budget spreadsheet?

It is perfectly okay to be simple and help your budget and expenses be written on a plain spreadsheet; we have this option for saving purposes.

All you need to do is make your financial report on a spreadsheet. Now, you might be wondering what the template should be and how it can be helpful. The better thing is you should use Microsoft Excel, Open Office Calculator, or Google Sheets. These three can help you out with spreadsheet templates for your monthly budget. Now, you have to download and open them in your spreadsheet software to get started.

- Budget Templates: Free budget spreadsheet software often comes with pre-designed budget templates that you can customize to fit your needs.

- Expense Tracking: You can track your expenses and income by entering them in the spreadsheet, which automatically calculates the totals and displays them in graphs and charts.

- Customizable Categories: You can customize expenses and income categories to match your budget.

- Monthly or Yearly Budget: You can create a monthly or yearly budget and track your progress against your goals.

- Savings Goals: You can set up savings goals and track your progress.

- Bill Reminders: You can set up reminders for upcoming bills to ensure you never miss a payment.

- Debt Tracking: You can track your debt payments and progress towards paying them off.

- Investment Tracking: You can track your investment accounts and monitor their performance.

- Tax Preparation: You can use budget spreadsheet software to prepare for tax season by tracking your deductible expenses.

- Export and Import Data: To streamline tracking your expenses and income, you can import and export data from other financial software, such as your website or a personal finance app.

This way, you can provide concrete evidence of how your invoices and bills cope and receive everything in one place. Although it is pretty complex, it is helpful if you have time; you can manage it. Nothing is impossible, but be careful to take care of all your receipts, bills, and invoices to keep the data handy and accurate.

Using a spreadsheet, you must manually enter all the data numbers evenly and accurately. Then, you need to come up with an idea or hall on how to save money, which commodities you can reduce your expenses from, and where you can invest more.

This is helpful since it can help you align with your expenses and budget. Since you helped me with your budget spreadsheet, you have everything in your mind that will remind you not to spend on terrible things. Now you know you have spent a lot, and your savings are less, which will motivate you to ultimately save more.

Here is a short reminder that you can use the up and totals options in Microsoft Excel to calculate the data all in one.

You can have multiple sheets on one page and save it as long as you want. The plus point is that your data will not be lost to anyone since it’s not an online tool. You can use it anytime, anywhere, just on the l; it will not be exposed to any online feature or platform.

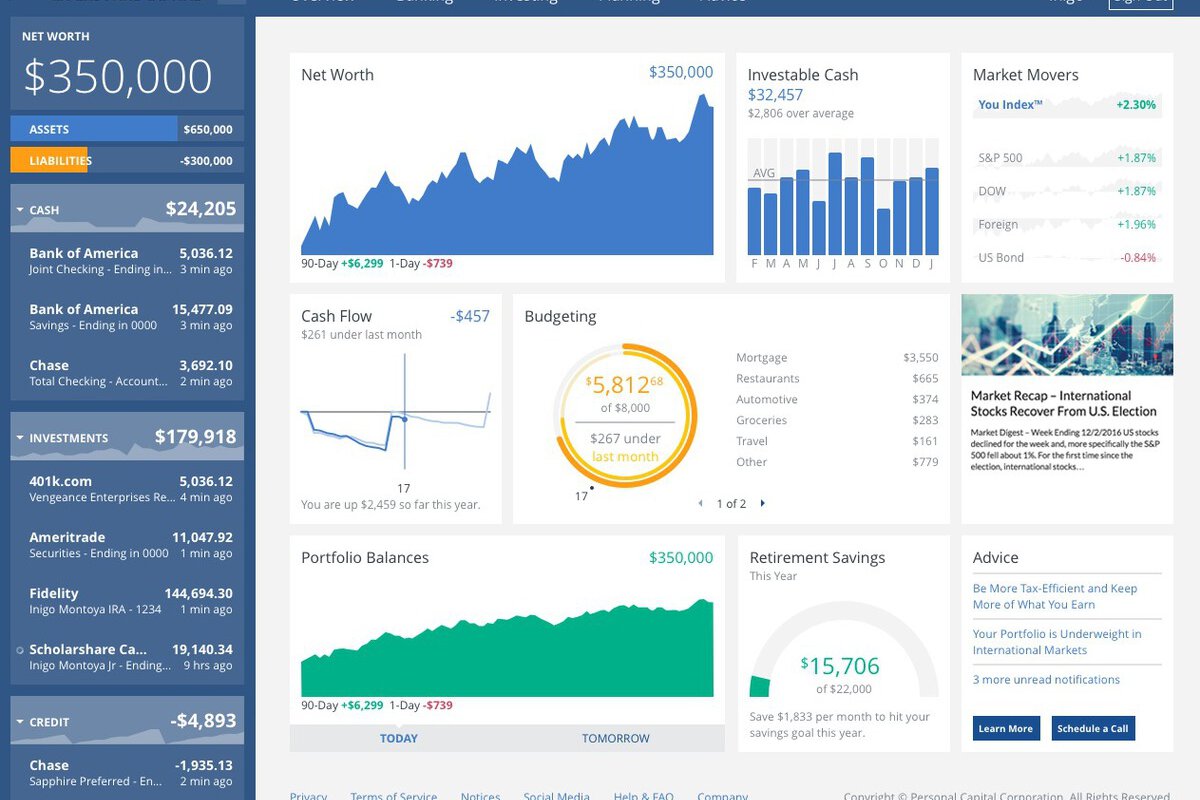

What is Personal Capital?

Personal capital is also a desktop software that can be useful in tracking your investment expenses, budgets, and all the things that other apps or structures offer. The best thing about personal capital software is that it can also help you plan for retirement and save enough money for your afterlife after retirement. In addition to all these factors, you can have a detailed report using the analysis tool for cash flow, expenses, budgeting and spending, and even your net worth.

So, as far as the investment is concerned, you can also use a side part of his budgeting complement in the software, but it is not merely focused on budgeting.

This software is helpful for investors, businesspeople, or anyone who owns a small business. However, if you’re looking for personal finance budgeting software and need complete help with this, private capital might not be the best fit since its primary focus is on investment.

Persoanl Capital Features

- Account Aggregation: Personal Capital allows users to link all their financial accounts, including bank accounts, credit cards, investment accounts, and loans, to get a complete picture of their finances.

- Budgeting: Personal Capital offers budgeting tools to help users create a budget and track their spending.

- Investment Tracking: Personal Capital provides a dashboard that displays uusers’investment portfolios and performance.

- Retirement Planning: Personal Capital offers retirement planning tools that help users set goals and plan for retirement.

- Net Worth Tracking: Personal Capital tracks uusers’net worth by aggregating all their financial accounts and calculating their assets and liabilities.

- Cash Flow Analysis: Personal Capital provides users with a cash flow analysis showing their income, expenses, and saving and spending patterns.

- Fee Analyzer: Personal CCapital’sfee analyzer tool helps users identify and analyze the fees they are paying on their investment accounts.

- Investment Advice: Personal Capital offers personalized investment advice based on uusers’financial goals and risk tolerance.

- Tax Optimization: Personal Capital provides strategies to help users reduce their tax liabilities.

- Mobile App: Personal Capital has a mobile app that allows users to access their financial information on the go.

Since we are talking about all the saving plans and how we can save more, investment is also a critical element that can help you save more and get more in the future if you save and want to have a double. You can invest it somewhere and earn a profit. In this critical time, this way, you can help yourself, and it is within your budget.

If you are afraid that your money will be gone and you will not have anything last, be patient, investments always take time, and it grows gradually. On the first note, you have to wait for a little and then definitely, you are going to get a great response, a good response, in the end, and it will go on like these investments always pay you off if not in a profit you can get your money back.

Coming back to personal capital, stop here. This App is Compatible with Android and iOS users and can be used on the Web, which is the perfect choice for business owners and investors.

What is Buddi?

Now comes our free and easy-to-use software. This budget software is compatible with Windows, Mac, and Linux systems. The plus point is that it is translated into multiple languages, which means many people from different languages or cultural backgrounds can use this software in their language, even if they ddon’tknow English.

This software is also significant from a security perspective since it is encrypted in financial data with a password, which means you can put your password on your financial data. No one can see it if they do not know the password.

Now, when it comes to its features, the budget software Buddy has different characteristics. He is budgeting, checking accounts, giving a personal finance report, and helping you with your expenses and whatnot. Although every so often has some plus points and some weak points, as we have discussed, here comes a weak point: you must enter all the transactions and your financial data meant to be in this Saturday.

Now, come to its features. The budget software buddy has different parts. He budgets a checking account, gives a personal finance report, and helps you with your expenses.

Although every so often there are some plus points and some weak points, and we have discussed the plus points, here comes a weak point: you have to enter all the transactions and your financial data meant to be in this Saturday.

If you know any other plug-ins and know how to use them, you can add more features by using those plug-ins in this app/software; it is not very hard to use if you have no financial background; you can still use this, but not any complications. As for compatibility, we have discussed that it is compatible with Windows, Mac OSx, and Linux, and iit’sgreat to use for budgeting.

So far, all these doctors or apps that we have discussed above are great in their perspectives, and feel you can use and choose any one of them as per your requirement with your choice; you can use all of them and get to know which feature which software helps you more and you can continue using them.

The reminder does not include all your financial details rright ifyyou downloadingit. Always research before you use and put your data in tAppApp. So far, all these software or programs have blessed me in their perspectives, and I would like any one of them to be. Use one or all of them and get to know the learner. Which software helps you more, and you can use them?

It? eminder:

Please do not put all your financial details right after you download it. Always do a little research before you use and set your data in the App…Use YouTube and other video tutorials regarding the app usage. Do a bit of investigation by visiting their website and reading their reviews. And once you get satisfied, you can continue using any help you want. Since we have talked about nearly all online personal finance budgeting software, but it still depends on your choice of what you want to use, we have discussed their features plus points and negative points in this article.

What is Microsoft Money Sunset Deluxe?

Last, we have our previous software, budgeting, and percent financing, Microsoft Money Sunset Deluxe. Adiscontinuingon of Microsoft Money Plus, Microsoft came up with this Money Sunset Deluxe, whicable almost free.

Since Microsoft Money Plus Sunset Dealer is the latest worry and has placed all its previous software versions, the only plus point we have with this software is that it is online only—self–help. That means you have to get along with this softer by self-help. There will be no online services after you can pay your online bill. There is no data synchronization, no online reports, and no status of financial data.

Since you won’t get any online service and will disappear, you must rely on yourself; it’s more or less likely, as in the Microsoft Excel spreadsheet. There are other limitations, and as a future update so far, beware of all these things and options before you choose this. As for gun compatibility, Microsoft Money Plus Sunset Dealer is compatible only with Windows, so Apple users cannot use it.

Conclusion

Always be more careful when giving or adding your personal information to any app or software. You can follow this great move to get the favorable and best results. A bit of carefulness will not hurt but will result in satisfaction.

You can have other ways to deal with this matter, but always remember that safety comes first, so try to be the one that follows SOPs to ensure that you remain safe while handling any other issues in this extreme pandemic situation.

Bring your mask along and wear it whenever you feel like having a conversation with other people. Wash your hands regularly and try to use gloves if you can easily do so.

Do not go out in a crowded area until or unless you are left with no choice or an emergency that you have. Be safe and make your friends and family follow the SOPs to ensure they are secure. Right now, it would be a great move if we stay at home, focus on our budgets, and spend digitally or manually the way we like. Plus, I want to spend more time working productively and efficiently with my family.