When tax season arrives, having all the documents to file your tax return accurately is essential. If you received unemployment benefits in New York, you will need the W-2 form. This article provides a detailed guide on how to obtain your W-2 form from unemployment in New York.

How do you obtain a W-2 Form from Unemployment in New York (NY)?

- Contact the Internal Revenue Service (IRS):

- Call the IRS helpline at 800-829-1040 to inquire about obtaining a copy of your previous year’s 1099-G form.

- Explain that you need the form to report unemployment benefits received in New York on your tax return.

- Request a Copy of the 1099-G Form:

- Inform the IRS representative that you require a copy of your 1099-G form for the specific tax year.

- Provide the necessary information, such as your full name, Social Security number, and the tax year.

- Fill out the IRS Form 4506-T:

- Visit the official IRS website at www.irs.gov and search for Form 4506-T.

- Download and print the form titled “Request for Transcript of Tax Return.”

- Fill out the form with accurate personal information, including your name, Social Security number, and address.

- Indicate the Purpose of the Request:

- In section 6, “Purpose of the Request,” check the box that says “Verification of Non-filing” or “Tax Return Transcript.”

- This will ensure you receive the information about your tax return and unemployment benefits.

- Choose the Appropriate Transcript Type:

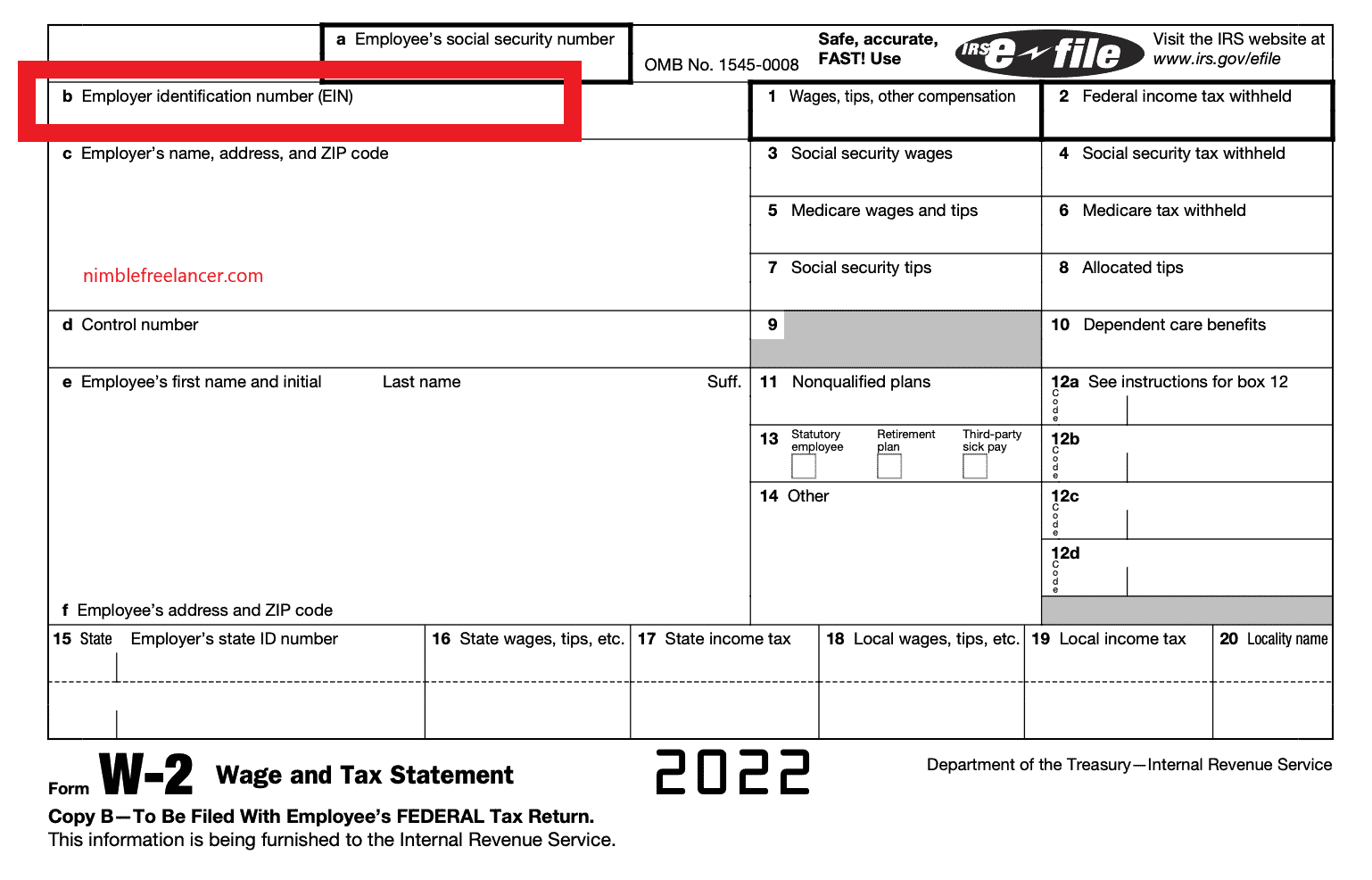

- In section 8, “Type of Transcript,” select “Wage and Income Transcript” or “Return Transcript” to request the information related to your W-2 form.

- Provide Additional Information, if Required:

- Depending on your situation, the IRS may require additional information to process your request.

- Follow the instructions on the form or provided by the IRS representative to ensure your request is complete.

- Mail the Completed Form to the IRS:

- Locate the IRS office in your area that processes transcript requests—for example, the IRS office at 290 Broadway, New York, NY 10007.

- Mail the completed Form 4506-T to the appropriate IRS office.

- Consider using certified mail or a similar service to track the delivery and ensure its safe arrival.

- Wait for Processing:

- After submitting your Form 4506-T, allow time for the IRS to process your request.

- Processing times may vary, so submitting your request before the tax filing deadline is advisable.

- Receive the Tax Return Transcript:

- Once the IRS processes your request, you will receive the tax return transcript, which includes the information from your W-2 form.

- Review the transcript to ensure all the necessary details, such as wages and taxes withheld, are included.

- Use the W-2 Information for Tax Filing:

- Utilize the tax return transcript information to complete your tax return accurately.

- Include the unemployment benefits reported on your W-2 form in the appropriate sections of your tax return.

Conclusion

Obtaining your W-2 from unemployment in New York involves contacting the IRS and requesting a copy of your 1099-G form or filing Form 4506-T to get the tax return transcript. Following the steps outlined above, you can ensure you have the documentation to file your tax return accurately and report your unemployment benefits appropriately. Consult with a tax professional or use reputable tax software to assist you.