When tax season arrives, having all the documents to file your tax return accurately is essential. You will need the W-2 form (Form 1099-G) if you received unemployment benefits in California. This article will guide you through obtaining your unemployment W-2 form in California.

What is the W-2 form?

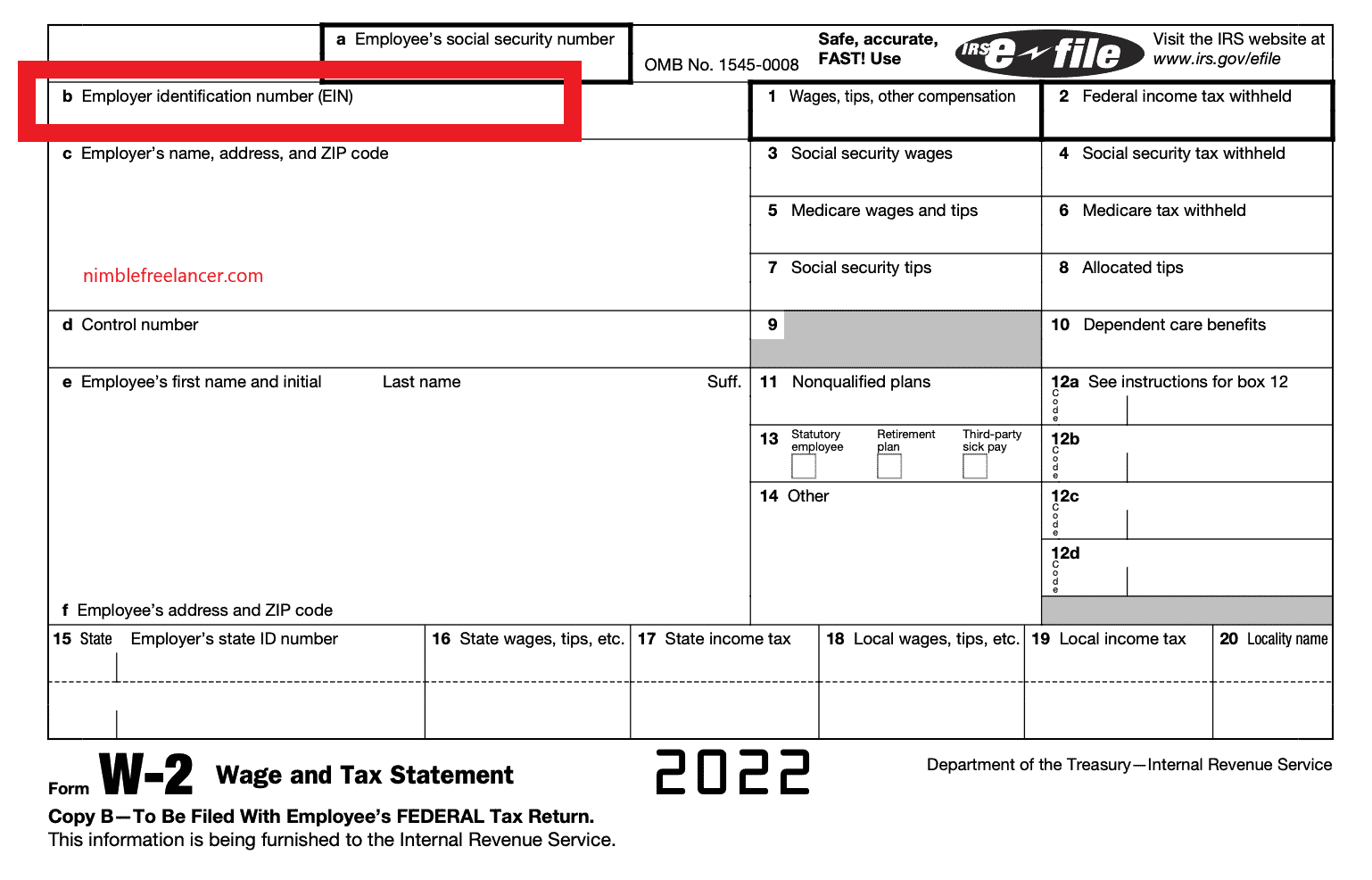

The W-2 form, or the Wage and Tax Statement, is a document employers in the United States must provide to their employees and report to the Internal Revenue Service (IRS). The form summarizes an employee’s annual earnings and the taxes withheld from their paycheck.

Here is a breakdown of the components and purposes of the W-2 form:

- Employee Information:

- The W-2 form includes the employee’s name, address, Social Security number, and employer’s identification number (EIN) and address.

- Earnings and Taxes:

- Box 1: Wages, tips, and other compensation earned by the employee during the tax year.

- Box 2: The federal income tax withheld from the employee’s earnings.

- Box 3: The total amount of wages subject to Social Security tax.

- Box 4: The amount of Social Security tax withheld from the employee’s earnings.

- Box 5: The total amount of wages subject to Medicare tax.

- Box 6: The amount of Medicare tax withheld from the employee’s earnings.

- Additional Information:

- Box 7: Tips allocated to the employee, including cash and credit card tips.

- Box 8: Allocated tips reported by the employer.

- Box 9: Verify the control number the employer assigned for record-keeping purposes.

- Box 10: Dependent care benefits provided by the employer.

- Box 11: Nonqualified plans.

- Box 12: Codes representing various compensation or benefits, such as retirement plan contributions or health insurance premiums.

- Box 13: Checkboxes indicating whether the employee participated in specific retirement plans, received third-party sick pay, or is a statutory employee.

- Box 14: This is an optional field where employers can report additional information, such as state disability insurance taxes or union dues.

- State and Local Information:

- The W-2 form also includes boxes for reporting state and local income tax withheld and wages subject to state or local taxes.

The W-2 form is crucial for both employees and the IRS. Employees use it to file their annual income tax returns accurately, while the IRS uses the information reported on the form to verify individuals’ income and ensure proper tax compliance.

How do you obtain an Unemployment W2 Form in California?

- Log in to Benefit Programs Online:

- Visit the official website of the Employment Development Department (EDD) in California at https://www.edd.ca.gov/.

- Locate and select the “UI Online” option on the website.

- Access Form 1099-G:

- Once logged in to UI Online, look for the section or tab that mentions “Form 1099G.”

- Click on the link or option that allows you to view the form.

- Select the Desired Tax Year:

- Choose the tax year for which you require the W-2 form.

- Typically, the form will be available for the most recent tax year.

- Print the 1099-G Form Information:

- After accessing the form, review the information displayed on the screen.

- Use the print function on your browser or computer to print a physical copy of the form.

- Ensure the printed copy includes all the necessary details, such as the amounts received in unemployment benefits.

- Request an Official Paper Copy:

- If you prefer to receive an official paper copy of your W-2 form, locate the option that says “Request Duplicate” or a similar phrase.

- Follow the instructions provided to initiate the request for a paper copy.

- It may be necessary to provide additional details or verify your identity during this process.

- Contact the Local Unemployment Office:

- If you encounter difficulties with the online process or prefer a more direct approach, you can contact your local unemployment office.

- Obtain their contact information from the EDD website or any previous correspondence you have received.

- Call or email the office to explain your situation and request assistance obtaining your W-2 form.

- Provide the Required Information:

- When contacting the unemployment office, be prepared to provide personal details, including your full name, Social Security number, and contact information.

- Follow any instructions or requests for information the office staff provides to facilitate the process.

- Wait for Processing:

- After submitting your request, whether online or through direct contact, allow some time for the unemployment office to process your request and prepare the W-2 form.

- The processing time may vary depending on the office’s workload and procedures.

- Receive and Verify the W-2 Form:

- Once the processing is complete, you will receive your W-2 form either by mail or electronically, depending on the method specified by the unemployment office.

- Upon receipt, carefully review the form to ensure all the information is accurate.

- If you identify any errors or discrepancies, promptly contact the unemployment office for assistance.

Conclusion

Obtaining your unemployment W-2 form in California involves accessing the EDD’s online portal, Benefit Programs Online, and following the steps outlined above. By logging in, accessing Form 1099-G, and printing the form’s information or requesting an official paper copy, you can ensure that you accurately have the necessary documentation for filing your taxes. Contacting the local unemployment office will provide guidance and support if you encounter any challenges.