A State Identification Number is also called the Federal Employer Identification Number or the Federal Tax Identification Number. This is an exclusive and individualized nine-digit number arranged by the Internal Revenue Service and tendered to business establishments and registered entities within the United States for legal identity.

The State Tax Identification Number, or EIN, is operated by businesses or organizations to file taxes, appoint business employees, and conduct business strategies. EINs can also be allocated if there are no workers or employees in a specific business organization. These numbers are essential for executing business dealings and handling business loans and license applications to prepare for an income tax return at the end of the year. As the Internal Revenue Service issues them, they are primarily used for federal purposes.

However, some states also assign a tax ID number to entities for the return of state tax.

How to find the employer’s state ID number?

To find the employer’s state ID number and Employer Identification Number (EIN), you must check your W-2 form, weekly paystub, or business tax return paper. The EIN is a nine-digit number that follows the format XX-XXXXXXX and usually can be seen in the top right (left) corner of the business tax return paper. However, you can always call the human resource or accounting department and ask a representative to look up your information.

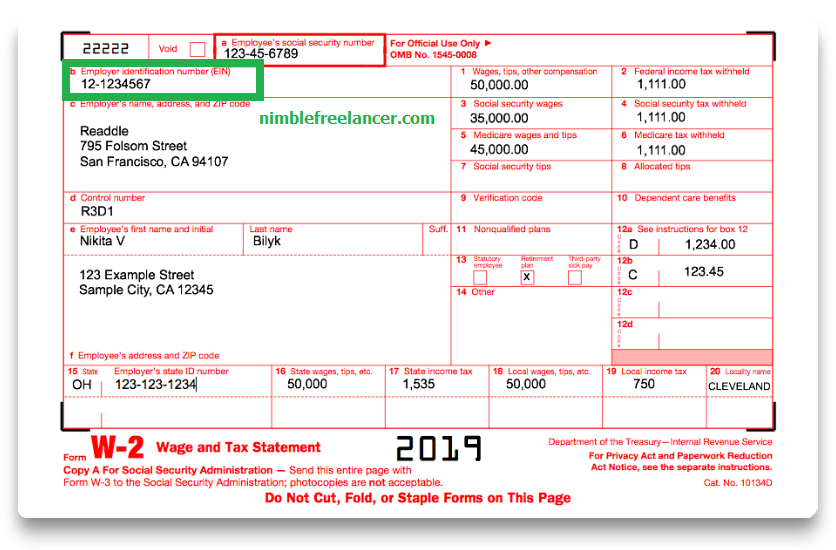

Let us show one example of how you can look up an employer’s state ID number EIN. I will mark EIN with green color:

In this W-2 report presented below, in the upper left corner, you can find EIN (green rectangle):

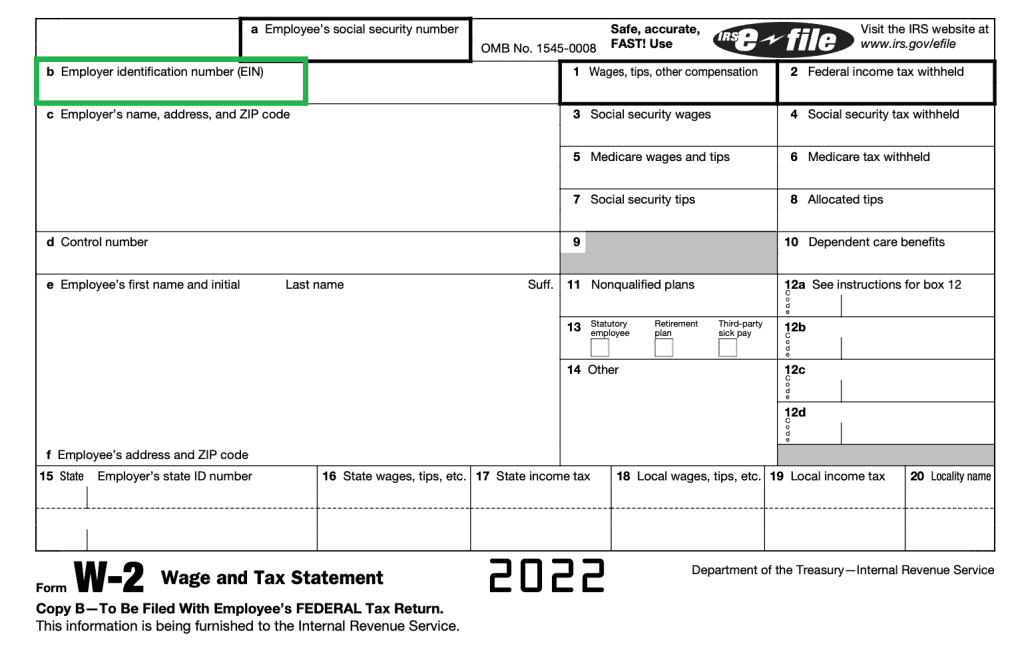

Now I will present the latest W-2 form for the year 2022 – the same as your EIN will be in the upper left corner:

You can watch the video below about Employer State ID Number Lookup:

State Identification Number is central to the state employer as it is used to amass and return the state income tax. Business entities that use Social Security numbers as an alternative for state EIN are exempt from practicing EIN. Therefore, knowing the employer’s state-personalized EIN is necessary to process the annual income taxes. This number lets you contact IRS agents with any queries regarding income tax withholding amounts. The EIN can be located on line 15 of the W-2 form received yearly at the end of January. To find it, the EIN is a nine-digit number written as XX – XXXXXXX. If you have any reservations or are experiencing trouble locating the personalized and unique number, call the employer’s human resource department and connect with the agent.

Keep your employer’s information and legal documents accessible if you need to contact the Department of Revenue for the particular state of residence. Visit govspot.com to get information about the state’s Department of Revenue. Employers also have the option to contact the department via phone or email. Alaska, Florida, Nevada, South Dakota, Washington, Texas, Wyoming, New Hampshire, and Tennessee do not deal with personal income tax or publish EINs.

The EIN is the businesses’ Social Security number. After launching a new business enterprise, the latest startup requires a name, selection of the entity type, registration of numerous bank accounts, creation of a business blueprint, and looking for a few investors to begin with. To implement business dealings and commitments, you must have a legal umbrella. Suppose there is a need to obtain a business license in a particular new area and register for the Paycheck Protection Program loan as a business owner. In that case, you must have an individual EIN relevant to your business.

EIN is the gateway to entrepreneurship as entrepreneurs will avoid legal obstacles and discrepancies with EIN possession. Following regular protocols and complying with the process blueprint may facilitate the business and simplify loan acquisition and tax filing. This number is used to procure and secure loans for future use and business reliability and credibility in the financial market. However, if you are a sole administrator and work individually, you are exempted from EIN. You only need it if the number of employees increases and the establishment increases its capacity by adding more contractors to the team. You will only require the number if you begin to register a tax withholding account.

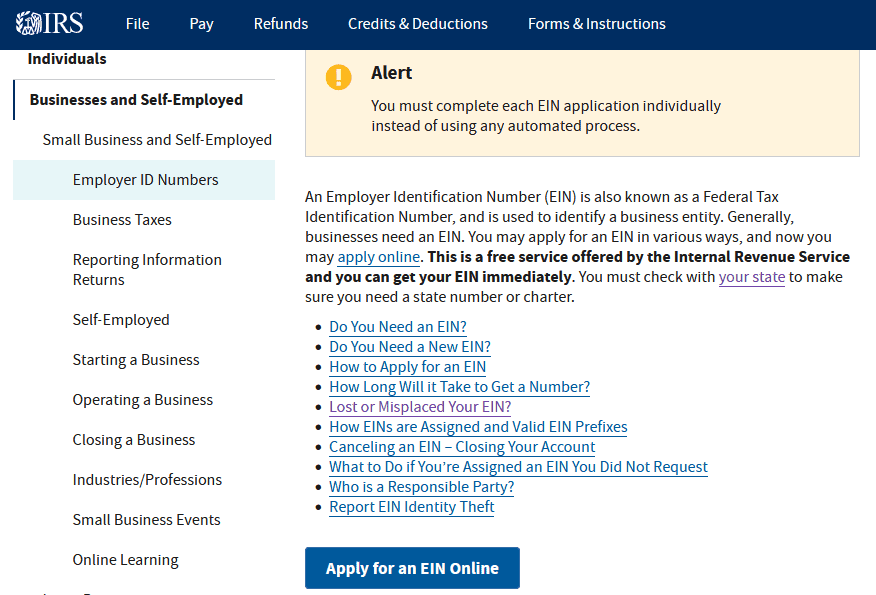

How do you find the Employer’s State ID number (EIN) using the IRS site?

You can visit the IRS Employer ID Number page to find your EIN, replace it, or apply for a new one.

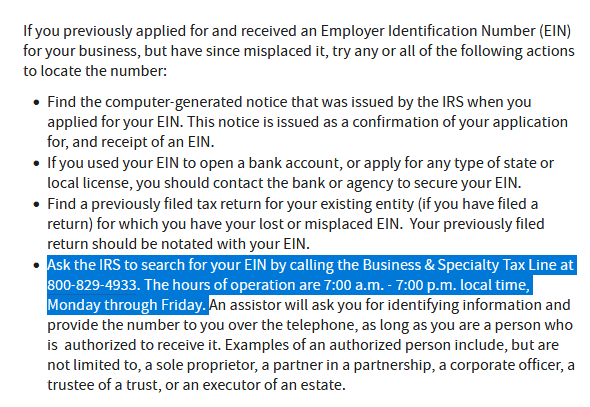

Additionally, there is a number that you can call to help you with EIN lookup. You can go to the IRS Lost or Misplaced Your EIN webpage. You can find the Business & Specialty Tax Line at 800-829-4933 and call from 7:00 a.m. to 7:00 p.m. local time.

How do you look up a State Employer Identification Number?

You can look up a state employer identification number in the following ways:

- Check entity documents

The IRS is responsible for delivering the EIN in a confirmation letter when an enterprise is registered. If you, as an entrepreneur, have registered for a new business and received EI, you must put it in a secure location, as you will need it for future use. This number is significant in terms of business dealings and moving forward with contractors and employees. You can also locate your EIN from tax account registration forms and state business licenses.

- Check Tax documents

The EIN is located in the top right corner of the business tax return paper. Suppose you open the return paper and find out that the EIN is highlighted with asterisks, probably for security purposes. In that case, you need to immediately contact the CPA and ask for an unknown number from them. If you are an expert in filing your tax returns using tax software, then the software has an option to remember the number every year. Go to the software’s business section and find EIN. - Ask Banker

If you have requested a permit, loan, or a business checking account, the banks will save the EIN on their file. In addition, your accountant or the relationship manager may have access to the EIN. - Ask Internal Revenue Service

This is the last yet secure option to retrieve your EIN. If the above options fail to provide you with your EIN, this is your last resort. Answer the verification and security questions to get the number from IRS agents. - Ask your employer’s human resource or accounting department.

You can visit the IRS website if you are new to the business and trying to obtain an EIN. The website will ask for the name of the company. The business establishment’s location has been decided to change into an entity type, and in that scenario, the EIN will need to change. For example, transforming EIN would be a good idea if you were a sole proprietor but have garnered more employees and contractors and partnered with any other corporation. To cancel the existing EIN, you need to finish and withdraw your tax account with the IRS. Otherwise, it is always linked to the business. If you are paying your business taxes and looking to secure a PPP loan, you will still require your EIN. It is also necessary to receive business crepromptlynner; therefore, the EIN should be placed safely.

The corporation number is equivalent to the federal tax identification number or an employer identification number (EIN).

How do you find your corporation number?

To find the corporation number, you usually need to see your EIN. You can find your corporation number (equivalent to the federal tax identification number or EIN) on your confirmation letter from the IRS or old tax returns. Alternatively, call the IRS Business & Specialty Tax Line at 800-829-4933.

If you are interested in tracking the EIN of another business enterprise, you need to have a traditional alliance with that company. The EIN of public companies is available on the SEC’s website. Nonprofit organizations and their EIN are general information; therefore, they are accessible on the IRS database.