Keeping costs down is a significant issue for our supermarket and convenience store clients. Maintaining minimal operational expenditures is crucial for protecting the meager profit margins. Interchange fees for transactions with debit cards are one example of hidden expenses. In the United States, debit cards have surpassed cash as the most popular purchase alternative to credit cards. Not all purchases made with a debit card undergo the same processing steps. Fees for taking Visa Debit may be significantly higher than those for accepting US Debit.

What is a US Debit card?

A US Debit card represents a debit card not tied to a bank account and is usually used for federal payments. US debit cards can be issued from usdebitcard.gov and operate on a platform enabled by Money Network®. US Debit Cards can be funded by sending an ACH credit to an agency. The agency can load money onto a prepaid debit card for the payee.

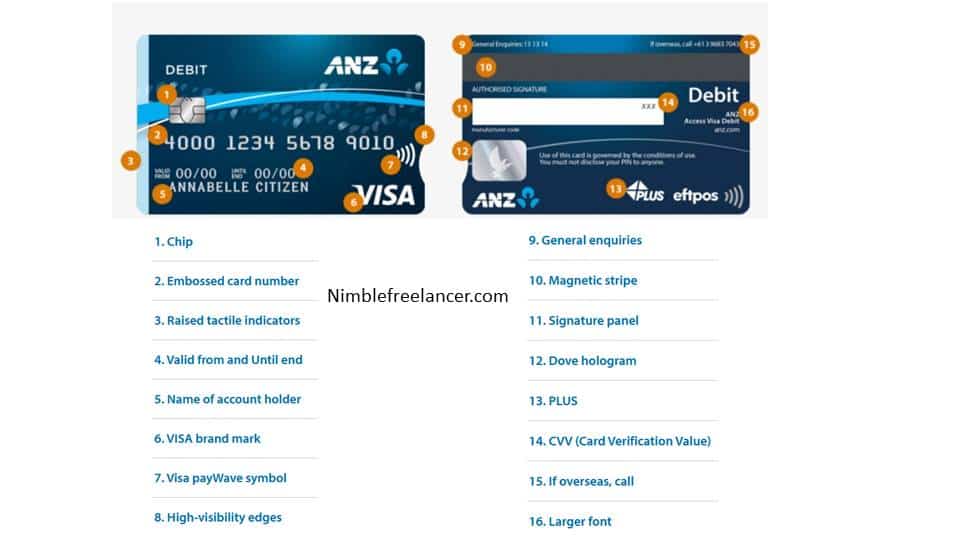

What is a Visa Debit card?

A Visa debit card represents a card issued by Visa and ties with your bank account. You can use your Visa debit card to shop online at all websites and apps (Visa is an accepted card on more than 99% of websites), with funds directly from your bank account.

US Debit vs. Visa Debit

The difference between US debit and Visa debit is that US debit always requires a PIN, while Visa debit does not necessarily need to use a PIN. While Visa debit is tied to your bank, US debit is not linked to any bank. Finally, practical applications differ between Visa debit and US debit because US debit is used for federal payments, where the agency can load money onto a prepaid debit card for the payee.

| Quart Bag Size | Cubic inches volume | TSA - less than 1 quart |

|---|---|---|

| 5.5 x 1.5 x 7 inches | 57.75 | Pass |

| 5.91 x 1.85 x 7.48 inches | 81.7 | Above 1 quart |

| 6.25 x 6.25 x 1 inches | 39 | Pass |

| 7.9 x 7.1 x 0.4 inches | 22.4 | Pass |

| 7 x 0.75 x 8 inches | 42 | Pass |

| 7.7 x 5.5 x 2.5 inches | 105.8 | Above 1 quart |

| 7.7 x 5.9 x 2 inches | 90.86 | Above 1 quart |

| 7.7 x 5.9 x 2.5 inches | 113.57 | Above 1 quart |

| 7.7 x 5.9 x 2.8 inches | 90.86 | Above 1 quart |

| 8 x 7 x 0.8 inches | 44 | Pass |

| 8.5 x 8.11 x 1.34 inches | 92 | Pass |

| 11.81 x 8.66 x 0.39 inches | 40 | Pass |

The federal government and the businesses and people it owes money to can benefit from using a U.S. Debit Card. The agency can load cash upon a prepaid debit card instead of writing a check, making a bank draft, or handing over money. Because of this, the U.S. Debit Card may be used by anybody, regardless of whether they have a bank or are willing to share such information with the government.

In place of a signature on the terminal or receipt, a Personal Identification Number (PIN) will be requested from the consumer when the “US Debit” option is chosen as a form of cardholder verification. Card provider funds must be present (bank) to make this choice. The gateway connects the store where the card was used for payment to the bank that issued the card in real time. Injecting Online PIN keys into a payment device enables PIN support, which allows a PIN to be encrypted and transmitted to a server for online validation.

Visa Debit is processed through the Visa credit card network. When using Visa (or Mastercard) Debit, the cardholder will not be prompted to enter a PIN, as is the case with US Debit—instead, the originator of the transaction. Credit card processing networks are used for the ‘Visa Debit’ payment method. Visa (or Mastercard) Debit cards, unlike US Debit cards, do not often need a PIN, and as a result, the cardholder will not be prompted to enter a PIN. A signature instead serves as authorization for the transaction. The funds for this option are borrowed from the card issuer and sent via Visa or Mastercard’s network.

Visa Debit Network vs. US Debit Network

Dual-Message Networks: Some credit card networks, like Visa Debit, also handle debit card transactions. These networks are frequently referred to as dual-message networks because they can carry out two separate tasks simultaneously. The first is a request for permission, and the second is a payment request. In this transaction, money is “borrowed” from the credit card network and “repaid” from the customer’s bank account.

Single-Message Networks: Many debit card transactions, including US Debit, are handled using the same single-message networks that financial institutions use for ATM transactions. A request is sent to the card issuer to withdraw funds from the customer’s account.

US Debit versus Visa Debit Costs

Interchange fees are charged for each electronic payment transaction. There is a big difference in the interchange fees that grocery stores and car dealerships pay. Five hundred debit card purchases at $100 apiece add up to $5,000 in monthly sales for a little supermarket. Every one of these clients uses a credit card issued by a bank that is not subject to the interchange fee cap. In this case, the interchange costs would amount to $270 if handled as Visa Debit transactions, averaging 54 cents per transaction. The interchange costs would amount to $125 if taken as US Debit transactions, at the expense of 25 cents for each transaction on average. That amounts to $145 more monthly or $1,740 more yearly. Furthermore, you may be able to save some cash.

Some debit card transactions are “covered” by the debit card issuer’s interchange fee waiver program, while others are “exempt” from the program due to the debit card issuer’s small size. The Durbin Amendment caps the interchange fees that small issuing banks (those with assets of less than $10 billion) can charge at a specified percentage of the transaction’s total. The maximum amount charged for a covered transaction is 21 cents plus 0.05% of the total amount to avoid fraud.

Because the amount you spend on fees depends on factors such as the average ticket size, the volume of transactions, and the banks used by your customers, it is impossible to provide an accurate estimate.

Conclusion

A US Debit card is for people who do not want to provide agency bank details and need to pay federal payments. However, a Visa debit card can be used in any other circumstance.