The minute it approaches calculating your “number” for retirement, one of the essential things to remember is that it is not about settling on a definite sum of money to save. For instance, the typical target for retirement savings in the United States is one million dollars in a savings account. However, this line of reasoning is flawed.

It is common practice for financial consultants to propose replacing around 79 percent of your income before retirement to maintain a similar way of life after retirement. That implies if you have an annual salary of a hundred thousand dollars, your goal should be to have eighty thousand dollars per year (in terms of today’s currency) when you retire.

On the other hand, there are several different aspects to consider; furthermore, not all of this money will have to arise as of your reserves. Keeping this in mind, the following is a strategy that might assist you in calculating the amount of currency prerequisite for retirement.

How Much Money Do I Need to Retire in the US?

Based on the latest 2022. Research shows that the minimum amount you need to retire in the US is 506K, while the optimum is 1.8 million dollars. However, your retirement amount depends on your lifestyle, US State living location, and your health. The average pre-retirement annual income in the US is around $80K, so the average yearly income for retirement should be $64K (80%).

Most experts suggest withdrawal revenue must be 80% of pre-retirement income. If you earn $100,000 per year, you’ll need $80,000 to live comfortably in retirement. You may alter this amount based on Communal Safety, annuities, part-time jobs, health, and lifestyle. If you want to travel substantially in retirement, you’ll need more.

One of the good ways to protect your investment retirement portfolio (such as an IRA, 401K) is to invest in Gold IRA. You can get more information below:

When calculating how much money you want to retire, the most significant consideration is whether or notyou’lll have the funds to generate the incomeyou’lll need to maintain the standard of living you want afteryou’vee left the workforce. Will having a savings balance of $1 million enable you to generate sufficient income for the rest of your life? Perhaps, but perhaps not. In this post, we will find out the answer to that question.

When you retire, you are often in a position to reduce spending, which means you won’t want to trade one hundred percent of your income from before you started collecting Social Security. Take, for instance:

- You may no longer need life insurance if you are no longer responsible for other people.

- By the time you retire, you may have spent less money on commuting expenditures and further expenses associated with work.You’lll no longer have to save for retirement (obviously).

- It is also possible that you will have to discharge your advance.

However, retiring on just 80 percent of your yearly salary is not ideal for many people. You could wish to revise your target amount upwards or downwards depending on the kind of superannuation way of life you see having and the degree to which your costs of living will vary dramatically.

For instance, if you want to spend a lot of time seeing the world once you retire, you might need to go for almost 100 percent of your income. Conversely, suppose you want to pay a repair loan before retiring or plan to reduce your living circumstances. In that case, you can live contentedly on a percentage of your income lower than 79 percent.

Assume for a moment that you fit the profile of a typical retiree. You and your partner bring in one lac twenty thousand dollars annually. According to the 80 percent rule, you may anticipate needing around $97,000 yearly income until you leave, equivalent to eight thousand dollars each month.

Pensions, Social Security, and other secure means of financial support

The bright side is that, if you’re like most people, you’ll receive some aid on bases except your reserves, like Social Security payouts. Social Security benefits are a significant source of income for most of the population.

However, pens higher-income pensioners have a lower replacement rate from Social Security. Fidelity, for instance, predicts that a person whose annual salary is about $50,000 may trade 35 percent of that income via Social Security benefits. However, a person paid $300,000 yearly should expect an auxiliary ratio of a fair 11 percent from Social Security.

Check your most recent Public Safety report or sign up for my Societal Safety account to receive a reasonable approximation created on your employment record if you are unsure what to anticipate.Don’tt forget to factor in any pensions you may be entitled to from past or present employment. The same holds for other reliable and long-term income streams, such as pension that begins paying out after the retiree reaches a certain age.

Continuing with our retired couple’s example of requiring $8,000 monthly income, let’s imagine that each partner anticipates $1,500 monthly from Social Security, and one partner also receives a $1,000 pension. This suggests that $4,000 of the required $8,000 monthly income comes from non-savings.

In conclusion, you may use the following formula to calculate an approximate monthly retirement income requirement:

The formula for Once-a-month Leaving Revenue

Monthly income required = Expenses for Retirement Each Month – Alternate monthly retirement income

Let’s figure out how much money you’ll need for retirement now. Once you know how much money you’ll need in retirement, you can determine how much you’ll need to save to have a steady income for the rest of your life.

One such tool is a retirement savings calculator. Alternately, you might employ the””four-percent rule”” According to the four-percent rule, retirees may spend up to four percent of their savings in the leading year of departure.

It depends on your current salary and retirement lifestyle. Saving””by ag”” may help you accomplish your retirement objectives. You may calculate the numbers using simple formulae.

Main features

- Your retirement savings requirement relies on your current income and desired lifestyle.

- Saving””by ag”” might help you accomplish your retirement objectives.

- You may calculate the numbers using basic formulae.

4 Percent retirement rule

There are various retirement savings calculators. The four-percent rule halves retirement income. $80,000 / 0.04 = $2 million needed to retire. This technique estimates a 5% investment return (afterward dues and price rises) and a similar lifestyle in retirement.

The last part of this article demonstrated that our couple would need to draw $5,000 per month (or $60,000 each year) from their savings. To be on an income of $60,000 a year, our couple would need to have more than 1.2 million dollars saved up in a retirement account such as a 401(k) or an individual retirement account (IRA).

4% Rule Formula:

Goal Savings for Retirement = Required Annual Income x 25

Youshouldn’tt blindly adhere to the four-percent rule since it has several flaws that need to be addressed. It is based on the assumption that you would withdraw the same amount from your retirement account each year (accustomed to price rises). It also presupposes that you will keep your retirementportfolio’ss equity and fixed-income assets in a healthy balance throughout your retirement years.

Life expectancy impacts the four-percent rule. The Four-percent law takes up 30-year retirement. Medicinal charges and further expenditures climb with age, so longer-living retirees need longer-lasting portfolios. The four-percent rule operates yearly. A large one-year purchase may reduce the principal, impacting compound interest.

Age-based pension savings

Perceiving how plentiful to save for retirement at each age helps answer the query,””When may I stop working and retire”” Here are several age-based retirement savings formulae.

Salary percentage

To determine how much money you will need at specific points in your life, save a proportion of your paycheck. Fidelity Investments recommends keeping 15 percent of your payment beginning in your20’ss. This includes retirement funds and company assistance if you have a 401(k) or similar owner-underwrote proposal.

Age-related retirement confidence

Is it not saving enough? Everyone’s together. According to a 2020 Charles Schwab study, saving for retirement is a worry for all generations. COVID-19 might influence participants” retirement money.

Thirty-eight percent of inspection defendants say they’ll save enough for retirement. 49% feelit’ss””somewhat plausible”” and 15 percent say””unlikely”” Early and midcareer retirement savings deficits are recoverable. It’s a great time to invest and earn more.

Pension calculator

You may plan for retirement with the aid of online calculators. Your retirement nest egg may be affected by funds and extraction charges. Online retirement calculators vary. Try T. RowePrice’s MaxiFi ESPlanner withdrawal revenue calculator.

Long-Term Financial Planning

There is no failsafe method for calculating the money you will need to save for retirement. The unpredictable nature of investment or time makes it challenging to forecastone’ss actual cash flow needs.

It is also essential to remember the potential income offered by the many different retirement plans varies greatly. Withdrawals from a traditional 401(k) plan or an individual retirement account (IRA) are taxable as income. On the other hand, if you have a Roth 401(k) or Roth IRA, the money you take out of such accounts is not taxable, which may cause the calculation to be somewhat different.

There may be other considerations to take into account. Many people are leaving the labor field because they retired earlier than expected. For example, the COVID-19 outbreak resulted in the forced early retirement of almost 3 million workers. Even when the economy is doing well, layoffs, health problems, and the need to care for family members are significant reasons why older people retire earlier than planned. Creating a savings cushion for a longer retirement brings a sense of calm.

Consider the impact of inflation on the money you have saved for retirement. People are talking a lot about inflation in 2022 since it is growing faster than in the last forty years. All families feel inflation’s consequences, but those aged 60 and above experience them more keenly than those who are still in the prime of their working lives. This is the case because a more significant portion of seniors’ wages is allocated toward essentials such as health care and living expenses, both of which have grown faster than general inflation.

While we have made an effort to provide you with an overview of the situation, it is in your best interest to consult with a financial adviser who can assist you in developing a leaving reserves objective appropriate for your circumstances and who can help you start on a reserves and asset strategy that will help you achieve that objective.

Using the tactics discussed in this article, you can estimate the money you will need to save for a pleasant retirement. Please don’t take this as gospel; instead, use it as a measuring stick to see how you’re doing and what adjustments may be required to get you where you want to go. Please don’t take this as gospel; use it as a measuring stick to see how you’re doing.

Experts in the field of retirement have provided many suggestions on how much money should be saved for retirement. These benchmarks include having a savings balance of close to one million dollars, saving more than eighty percent of your annual salary before retirement, or saving more than ten times your wage. But what do you believe is the most suitable option? And how exactly do you determine whether or not you are going in the correct direction?

The demands of each individual will vary greatly depending on various circumstances. These include your current age, your expected retirement age, or when you might be forced to stop working due to deteriorating health, job loss, illness, or any other unavoidable setback; the amount of money you expect to spend during retirement; and the sources of income you anticipate having during retirement.

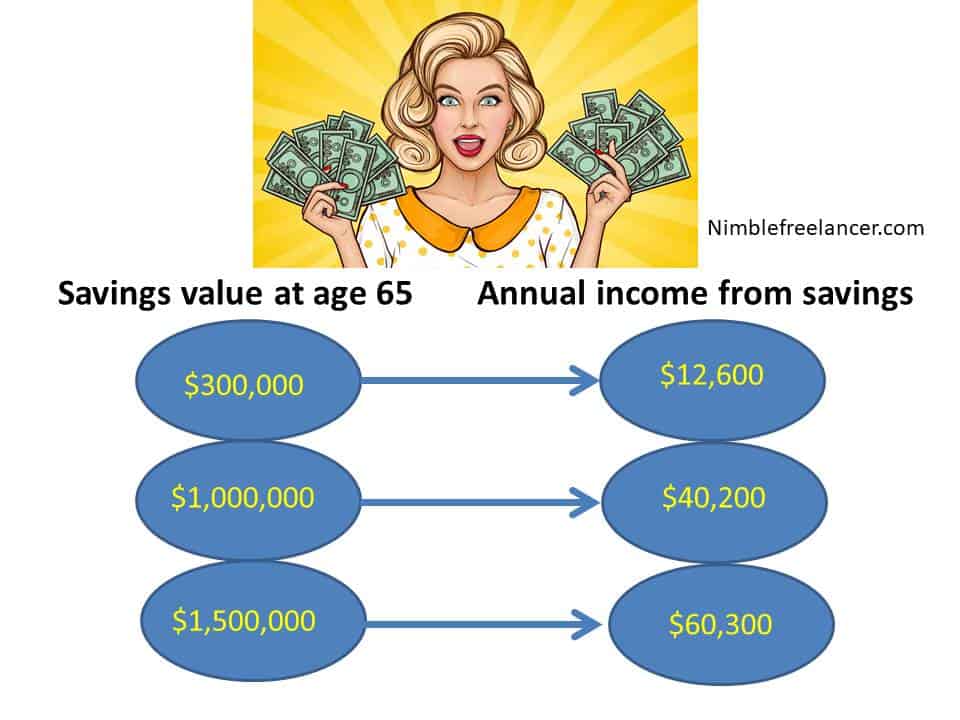

Even substantial accounts may surprise people with how ample or how minute they offer over the length of retirement. This might be the case either way. The illustrations show how much of their retirement savings a person aged 65 may comfortably withdraw in their leading year of stepping down.

At the age of 65, if savings are $300,000, then the yearly income from savings would be $12,060; if savings are $1,000,000, then the annual income from savings would be $40,200; and so on.

Not only what you save and put money into investments will define how big of a nest egg you should have and how long it may last in retirement, but also how you will use that money after you have reached that stage will affect how you will use that money once you have reached that point. When calculating your reserves, you must consider several factors, including those listed below:

| Veefly campaigns | Sprizzy campaigns |

|---|---|

| Youtube ads are published faster in 12 hours buy average. | Youtbe ads are published slower in 72 hours by average. |

| For $1 investment I got by average 49 views (several different campaigns) | For $1 investment I got by average 31 views (several different campaigns) |

| For $1 investment I got 58 views using Veefly for finance related video promotion. | For $1 investment I got 17 views using Sprizzy for finance related video promotion. |

| During Veefly campaign I earned $16.7 youtube revenue ($50 investment) | During Sprizzy campaign I earned $0.24 youtube revenue ($50 investment). |

| Promoted video earned 4 subscribers on Veefly. | Promoted video earned 1 subscribers on Sprizzy. |

| Veefly allows only targeted country to set. | Sprizzy allows several market segemntations such as country, age, gender, related youtube channels etc. |

Table: How will you spend your retirement money?

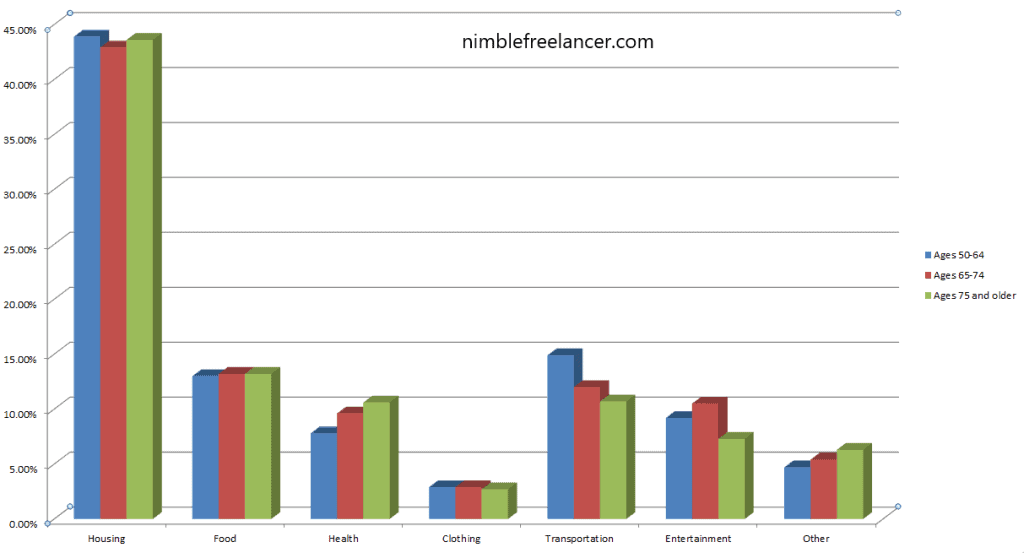

Employee Benefit Research Institute (EBRI) can provide you with a general sense of how you may be able to expect your household expenses to shift in retirement concerning your current lifestyle in terms of location, size, the number of people living in your household, food, healthcare, mode of transportation, to assist you in determining how much money you may require. If you want to travel more, host more parties, or participate in a costly pastime, you must consider including some funds for such costs that are more flexible and up to your discretion. When calculating how much money you will need for retirement, one crucial factor to bear in mind is the possible influence that taxes might have onone’ss income during retirement.

Even though certain costs, such as medical care, may go up when you retire, it is essential to remember that there may be possibilities to save money in other areas.”According to the results of specific experts, after people reach retirement age, they tend to spend their time engaging in activities such as considerate shopping and preparing meals for their families. The actual cost of living for them, which includes items like these, pushes down the overall cost of living for them.”Storey brings more.

Notice potential sources of revenue that might contribute to covering your costs.

As you investigate how much cash you could want in retirement, remember that the sum of money you choose to reserve and participate in is just one constituent of your retirement income.

Most working-age Americans can rely on Social Security as the primary source of revenue for their retirement income, which is an important cornerstone. Also, make sure that you don’t overlook the possibility of earning money in the future from a variety of other sources, such as the funds in your workplace and private retirement accounts, the money you receive from pensions and annuities, the proceeds from the sale of your home or business, and the income you receive from renting out your property. It would help if you considered all of these potential sources of revenue.

Be sure that your expectations align with what is possible if you want to continue working when you retire so that you may reduce the amount of money you save each year. The results of the annual Retirement Confidence Survey conducted by the EBRI have shown, year after year, that American employees are far more likely to anticipate continuing to work after retirement than they are to do so.

According to the most recent EBRI survey, 72 percent of employees intended to continue working when they retired, yet just 30 percent of retirees now claim that they undertake paid employment.

You may estimate the amount you want to withdraw from your private reserves every year after you retire more accurately if you understand your after-withdrawal costs and income. However, if your objective is many decades in the future, it might be challenging to translate it into a reasonable amount of money to invest right now. You may point to two methods to point to your development and determine if any adjustments need to be made.

- To get a fast idea of where you stand in comparison to other people who have money:

During your physical examination every year, understanding how your vitals stand up contrary to the average (heart rate, blood pressure, and weight) may be quite instructive.Merrill’ss Proportion of Total Assets to Annual Income allows you to compare your retirement savings with those of your contemporaries. In the same way, it can be helpful to see how your heart rate, blood pressure, or weight compares with the”norm.”

If Jane, age 35, who makes above 70 thousand dollars a year, wanted to multiply her current pay by 1.4 and then compare that result to the savings rates of the top savers in her age bracket. For example, if Jane wanted to notice her reserves boost her current pay by 1.4 to get to the same level as the most excellent savers in her age group.

Therefore, to stay among the”top stockholders” in her age group, she needed to have $98,000 in savings in her financial plan thus far.

- Assess current circumstances and determine the necessary course corrections to ensure future success.

Use the Merrill Personal Retirement Calculator. You will have the opportunity to acquire an estimate of investments to determine whether or not there will be a gap between the resources you now have and the needs you will have when you retire. After that, it offers assistance in modifying your approach to the projection results.

With thecalculator’ss assistance, you will see how any future adjustments to your reserve aim, withdrawal duration, and asset choices could affect the overall amount of money you put aside for retirement. If, on the other hand, this barrier signals that you are beyond wherever you may be, Storey advises that you should not allow yourself to be dismayed by the big numbers that you may observe.

You can find that adjusting your funds will yield a significant windfall thirty years from now.

What you set aside and finance for an extended period may significantly impact your financial situation.”Even a one percent rise may signify a lot in the long run,” he adds.”Even a one percent boost can be significant if more savings are required.” Take, for example:

- If you save 5% of your yearly pay of $50,000, you will have $210,000 in your savings account after 30 years.

- If you save 6% of your annual salary of $50,000, you will have $251,000 in your savings account after 30 years.

Considering how little the typical American has saved for retirement, the outlook is not encouraging.

According to a poll by GOBankingRates, 40% of American adults have under $300 saved, which will severely impact their ability to retire comfortably. As stated by the Pew Charitable Trusts, many Americans expect to continue working beyond the traditional retirement age of 65 due to financial concerns. Somepeople’ss futures were also doubted because of the epidemic, particularly those who dip into their retirement funds because of a loss of job or vacation.

However, because of variations in the budget from state to state, the sum required to retire is not the same for everyone. If you live in a more expensive part of the nation, a nest egg of little over $500,000 could be sufficient to fund your golden years. If you want to retire comfortably in other parts of the world,you’lll need to save around $2 million.

Using data from the Bureau of Labor Statistics and the Missouri Economic Research and Information Center, GOBankingRates determined the yearly expenses for a retired individual in each state, less the amount received by Social Security. The states were rated from least to most in need of a nest egg, assuming they would withdraw 4% annually to fund living expenditures.

According to GOBankingRates’ analysis, many southern and western states, like Kansas and Mississippi, need under $550,000 in retirement savings. However, the Northeastern federations are not so fortunate; seven of the ten least affordable retirement places are located there.

How much do you need to retire based on US State?

1- How much money do you need to retire in the Mississippi?

If you live in Mississippi, your average annual budget is around $40K. Hence, your budget after using Social Safety revenue is $20.2K. The minimum money you need to retire in Mississippi is approximately $506K.

2- How much money is required for Kansas retirement?

The average yearly budget in Kansas is roughly $41K. As a result, your budget after Social Safety revenue is $22K. In Kansas, the minimum amount needed to retire is approximately $555K.

3- How much money is required for Alabama retirement?

The average yearly budget in Alabama is roughly $42K. As a result, your budget after Social Safety revenue is $22K. In Kansas, the minimum amount needed to retire is approximately $560K.

4- How much money is required for Oklahoma retirement?

The average yearly budget in Oklahoma is roughly $42K. As a result, your budget after Social Safety revenue is $23K. In Kansas, the minimum amount needed to retire is approximately $560K.

5- How much money is required for Georgia’s retirement?

The average yearly budget in Georgia is roughly $42K. As a result, your budget after Social Safety revenue is $23K. In Kansas, the minimum amount needed to retire is approximately $570K.

6- How much money is required for Tennessee retirement?

The average yearly budget in Tennessee is roughly $42K. As a result, your budget after Social Safety revenue is $23K. In Kansas, the minimum amount needed to retire is approximately $573K.

7- How much money is required for Missouri retirement?

The average yearly budget in Missouri is roughly $43K. As a result, your budget after Social Safety revenue is $23.3K. In Kansas, the minimum amount needed to retire is approximately $582K.

8- How much money is required for Lowa’s retirement?

The average yearly budget in Lowa is roughly $43K. As a result, your budget after Social Safety revenue is $23.3K. In Kansas, the minimum amount needed to retire is approximately $584K.

9- How much money is required for West Virginia retirement?

The average yearly budget in West Virginia is roughly $43K. As a result, your budget after Social Safety revenue is $23.6K. In Kansas, the minimum amount needed to retire is approximately $600K.

10- How much money is required for Indiana retirement?

The average yearly budget in Indiana is roughly $43K. As a result, your budget after Social Safety revenue is $23.6K. In Kansas, the minimum amount needed to retire is approximately $592K.

11- How much money is required for Arkansas retirement?

The average yearly budget in Arkansas is roughly $43K. As a result, your budget after Social Safety revenue is $23.8K. In Kansas, the minimum amount needed to retire is approximately $596K.

12- How much money is required for New Mexico retirement?

The average yearly budget in New Mexico is roughly $43K. As a result, your budget after Social Safety revenue is $23.8K. In Kansas, the minimum amount needed to retire is approximately $597K.

13- How much money is required for Michigan retirement?

The average yearly budget in Michigan is roughly $43.4K. As a result, your budget after Social Safety revenue is $24K. In Kansas, the minimum amount needed to retire is approximately $600K.

14- How much money is required for Ohio retirement?

The average yearly budget in Ohio is roughly $43.4K. As a result, your budget after Social Safety revenue is $24K. In Kansas, the minimum amount needed to retire is approximately $600K.

15- How much money is required for Texas retirement?

The average yearly budget in Texas is roughly $43.8K. As a result, your budget after Social Safety revenue is $24K. In Kansas, the minimum amount needed to retire is approximately $610K.

16- How much money is required for Louisiana retirement?

The average yearly budget in Louisiana is roughly $44K. As a result, your budget after Social Safety revenue is $24.8K. In Kansas, the minimum amount needed to retire is approximately $621K.

17- How much money is required for Florida retirement?

The average yearly budget in Florida is roughly $47.7K. As a result, your budget after Social Safety revenue is $28K. In Kansas, the minimum amount needed to retire is approximately $707K.

18- How much money is required for Hawaii retirement?

The average yearly budget in Hawaii is roughly $91.9K. As a result, your budget after Social Safety revenue is $72K. In Kansas, the minimum amount needed to retire is approximately $1813K.

19- How much money is required for Maryland retirement?

The average yearly budget in Maryland is roughly $58.9K. As a result, your budget after Social Safety revenue is $39.5K. In Kansas, the minimum amount needed to retire is approximately $989K.

20- How much money is required for Connecticut retirement?

The average yearly budget in Connecticut is roughly $57.9K. As a result, your budget after Social Safety revenue is $38.5K. In Kansas, the minimum amount needed to retire is approximately $961K.

21- How much money is required for Rhode Island retirement?

The average yearly budget in Rhode Island is roughly $55.7K. As a result, your budget after Social Safety revenue is $36K. In Kansas, the minimum amount needed to retire is approximately $909K.

22- How much money is required for Vermont retirement?

The average yearly budget in Vermont is roughly $55K. As a result, your budget after Social Safety revenue is $36K. In Kansas, the minimum amount needed to retire is approximately $906K.

23- How much money is required for New Jersey retirement?

The average yearly budget in New Jersey is roughly $55K. As a result, your budget after Social Safety revenue is $35K. In Kansas, the minimum amount needed to retire is approximately $885K.

24- How much money is required for Washington’s retirement?

The average yearly budget in Washington is roughly $53K. As a result, your budget after Social Safety revenue is $34K. In Kansas, the minimum amount needed to retire is approximately $842K.

25- How much money is required for Maine retirement?

The average yearly budget in Maine is roughly $55K. As a result, your budget after Social Safety revenue is $35K. In Kansas, the minimum amount needed to retire is approximately $882K.

26- How much money is required for New Hampshire retirement?

The average yearly budget in New Hampshire is roughly $52.2K. As a result, your budget after Social Safety revenue is $33K. In Kansas, the minimum amount needed to retire is approximately $822K.

27- How much money is required for Kentucky retirement?

The average yearly budget in Kentucky is roughly $44.3K. As a result, your budget after Social Safety revenue is $25K. In Kansas, the minimum amount needed to retire is approximately $622K.

28- How much money is required for Illinois retirement?

The average yearly budget in Illinois is roughly $44.8K. As a result, your budget after Social Safety revenue is $25.4K. In Kansas, the minimum amount needed to retire is approximately $636K.

29- How much money is required for Nebraska retirement?

The average yearly budget in Nebraska is roughly $44.6K. As a result, your budget after Social Safety revenue is $25K. In Kansas, the minimum amount needed to retire is approximately $629K.

30- How much money is required for South Carolina retirement?

The average yearly budget in South Carolina is roughly $44.5K. As a result, your budget after Social Safety revenue is $25K. In Kansas, the minimum amount needed to retire is approximately $628K.

31- How much money is required for Wisconsin retirement?

The average yearly budget in Wisconsin is roughly $46K. As a result, your budget after Social Safety revenue is $26.4K. In Kansas, the minimum amount needed to retire is approximately $661K.

32- How much money is required for North Carolina retirement?

The average yearly budget in North Carolina is roughly $46K. As a result, your budget after Social Safety revenue is $26K. In Kansas, the minimum amount needed to retire is approximately $653K.

33- How much money is required for Wyoming retirement?

The average yearly budget in Wyoming is roughly $45K. As a result, your budget after Social Safety revenue is $25.4K. In Kansas, the minimum amount needed to retire is approximately $636K.

34- How much money is required for Minnesota retirement?

The average yearly budget in Minnesota is roughly $48K. As a result, your budget after Social Safety revenue is $28K. In Kansas, the minimum amount needed to retire is approximately $704K.

35- How much money is required for Utah retirement?

The average yearly budget in Utah is roughly $47K. As a result, your budget after Social Safety revenue is $27.6K. In Kansas, the minimum amount needed to retire is approximately $692K.

36- How much money is required for North Dakota retirement?

The average yearly budget in North Dakota is roughly $46.7K. As a result, your budget after Social Safety revenue is $27.3K. In Kansas, the minimum amount needed to retire is approximately $683K.

37- How much money is required for South Dakota retirement?

The average yearly budget in South Dakota is roughly $48K. As a result, your budget after Social Safety revenue is $28.6K. In Kansas, the minimum amount needed to retire is approximately $716K.

38- How much money is required for Montana’s retirement?

The average yearly budget in Montana is roughly $48K. As a result, your budget after Social Safety revenue is $28.4K. In Kansas, the minimum amount needed to retire is roughly $712.3K.

39- How much money is required for Delaware retirement?

The average yearly budget in Delaware is roughly $51.3K. As a result, your budget after Social Safety revenue is $31.9K. In Kansas, the minimum amount needed to retire is roughly $797.9K.

40- How much money is required for Nevada retirement?

The average yearly budget in Nevada is roughly $50.5K. As a result, your budget after Social Safety revenue is $31K. In Kansas, the minimum amount needed to retire is roughly $778.9K.

41- How much money is required for Colorado retirement?

The average yearly budget in Colorado is roughly $50K. As a result, your budget after Social Safety revenue is $30.6K. In Kansas, the minimum amount needed to retire is approximately $767K.

42- How much money is required for Arizona retirement?

The average yearly budget in Arizona is roughly $49K. As a result, your budget after Social Safety revenue is $29.6K. In Kansas, the minimum amount needed to retire is approximately $742K.

43- How much money is required for Pennsylvania retirement?

The average yearly budget in Pennsylvania is roughly $48.7K. As a result, your budget after Social Safety revenue is $29.3K. In Kansas, the minimum amount needed to retire is roughly $733.7K.

44- How much money is required for Idaho retirement?

The average yearly budget in Idaho is roughly $48.5K. As a result, your budget after Social Safety revenue is $29K. In Kansas, the minimum amount needed to retire is approximately $729K.

45- How much money is required for Virginia’s retirement?

The average yearly budget in Virginia is roughly $48.4K. As a result, your budget after Social Safety revenue is $29K. In Kansas, the minimum amount needed to retire is roughly $725.3K.

46- How much money is required for Massachusetts retirement?

The average yearly budget in Massachusetts is roughly $64K. As a result, your budget after Social Safety revenue is $44.8K. In Kansas, the minimum amount needed to retire is roughly $1120.3K.

47- How much money is required for Oregon retirement?

The average yearly budget in Oregon is roughly $62K. As a result, your budget after Social Safety revenue is $42.4K. In Kansas, the minimum amount needed to retire is approximately $1062K.

48- How much money is required for Alaska retirement?

The average yearly budget in Alaska is roughly $60.4K. As a result, your budget after Social Safety revenue is $41K. In Kansas, the minimum amount needed to retire is roughly $1026.3K.

49- How much money is required for New York retirement?

The average yearly budget in New York is roughly $70.5K. As a result, your budget after Social Safety revenue is $51K. In Kansas, the minimum amount needed to retire is roughly $1277.3K.

50- How much money is required for California retirement?

The average yearly budget in California is roughly $67.7K. As a result, your budget after Social Safety revenue is $48.2K. In Kansas, the minimum amount needed to retire is approximately $1206K.

Conclusion

Sometimesyou’lll save extra for retirement, sometimes less. Make sureyou’ree on track by checking off each milestone as you go to reach your savings target.

Start there if you can use a 401(k). If not, think through an IRA. We’ve compiled listings of agents for IRAs and Roth IRAs so you may open these superannuation accounts.